What are phishing, smishing and vishing scams?

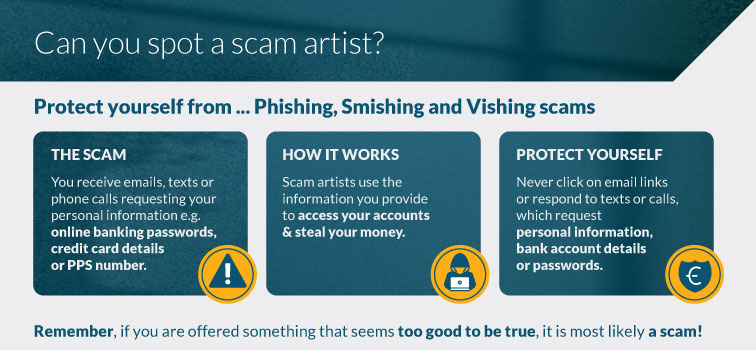

Phishing, smishing and vishing are amongst the most common techniques used by scam artists. The scam artists use emails, text messages, or phone calls to trick you into giving them valuable personal information such as your online banking passwords, credit card details or PPS number.

How do phishing, smishing and vishing scams work?

Phishing occurs when scam artists send emails – that appear to be from legitimate sources – to trick you into giving up personal data, such as login details or credit card information.

Smishing occurs when you receive text messages that look to be legitimate, such as from Revenue, An Post, or your bank. Scam artists use these fraudulent text messages to trick you into revealing personal or financial information or to get you to click malicious links.

Vishing, short for voice phishing, refers to fraudulent phone calls or voice messages designed to trick you into providing sensitive information, like login credentials, credit card numbers, or bank details.

These attempts can be difficult to spot and may even appear within a genuine “thread” of text messages you may have received from a legitimate organisation. The message may say your account has been compromised and you need to reset your password. Or it may say that you need to pay a customs charge for an item you’ve ordered online to be delivered. The aim of the scams is to get you to provide your online banking details, credit card information or other personal financial information. The scam artist then uses this information to access your account and steal your money.

How can you protect yourself from phishing, smishing and vishing scams?

- Be suspicious of text messages received out of the blue that claim to come from a reputable organisation, such as your bank or credit/debit card issuer, An Post or Revenue.

- Do not respond to texts, emails or phone calls requesting personal information such as your bank account details or other passwords.

- Do not call any phone number or click on any link embedded within a text message.

- Be cautious of messages that prompt you to visit a website to resolve an issue or verify your details urgently.

- Only reset your online passwords if you initiated the reset.