Payment Statistics Quarterly

Last updated: 15 October 2025

The amended Payment Statistics Regulation (ECB/2020/59) introduced in 2022 provides a more granular approach to reporting requirements, which allows Central Banks to have a greater perspective on developments in retail payments domestically and more generally in Europe. Payment transactions reported in the Payment Statistics Quarterly (PSQ) by payment services providers relate to non-cash payments by non-monetary financial institutions which include credit transfers, direct debits, card based payment transactions, E-money transactions and cheques.

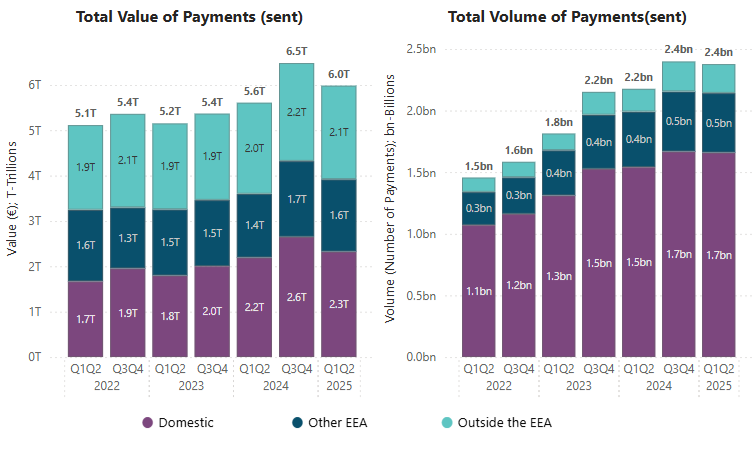

2.4 billion Total Payment Transactions during First Half of 2025

- During the first half of 2025, the number of payment transactions reported by Irish payment service providers (PSPs) remained broadly steady at 2.4 billion, a marginal decrease of 0.9 per cent (21.2 million) compared to the second half of 2024. The value of these payments declined by 7.7 per cent to €6.0 trillion from €6.5 trillion in the second half of 2024.

- Annual changes showed a steady growth in both the value and the volume of payments compared to the first half of 2024. Value increased by 6.7 per cent or €0.4 trillion and volume rose by 9.2 per cent or 0.2 billion. (Chart 1)

Chart 1: Total Value and Volume (Number) of Payments Transactions (sent) by region

- Domestic payment transactions accounted for 66.7 per cent (1.7 billion) of overall payments volume in the first half of 2025, totalling €2.3 trillion. This is a 7.6 per cent or €117.6 billion annual increase in value from €2.2 trillion in the first half of 2024.

- Cross-border payments to countries outside the European Economic Area (EEA) make up a smaller share of transfers, amounting to 9.9 per cent or 236.1 million. However, the value of these transactions remained on par with domestic payments, amounting to €2.1 trillion during Q1&Q2 2025.Cross-border payments to ‘Other EEA’ countries totalled 0.5 billion in volume and €1.6 trillion in value.

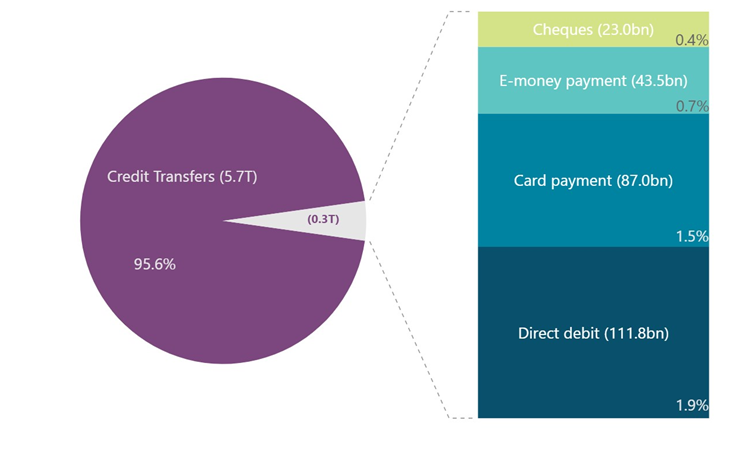

- In line with past trends, credit transfers remained as the dominant payment method accounting for 95.6 per cent (€5.7 trillion) of the total transaction value in the first half of 2025. Direct debits represented the next largest share at 1.9 per cent (€111.8 billion), followed by card payments at 1.5 per cent (€87.0 billion). E-money payments and cheques collectively accounted for 1.1 per cent of total value at €43.5 billion and €23.0 billion respectively (Chart2).

- Card payments dominated in the volume of transactions constituting 66.3 per cent (1.6 billion) of the overall total volume, followed by credit transfers at 21 per cent (0.5 billion) in the first half of 2025.

Chart 2: Value of Total Payments Transactions (sent) during Q1 and Q2 2025 by payment method

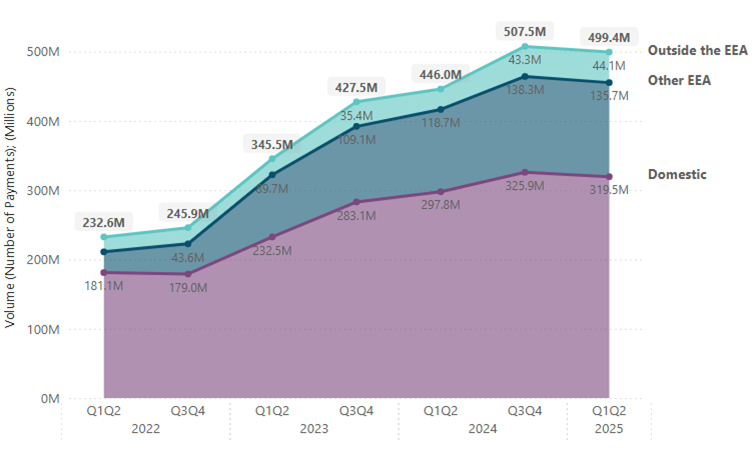

Credit Transfers (sent) Amount to €5.7 Trillion during first half of 2025

- In the first half of 2025, the total value of credit transfers amounted to €5.7 trillion, representing a 7.9 per cent decline from €6.2 trillion recorded in the second half of 2024. This decrease was largely attributed to a 13 per cent drop in domestic credit transfers, falling from €2.5 trillion to €2.1 trillion over the period.

- The volume of credit transfers, which experienced a continuous growth from 2022, fell by 1.6 per cent to 499.4million in the first half of 2025 from 507.5 million in the second half of 2024(Chart 3). However, compared to the first half of 2024, both value and volume displayed strong annual growth, increasing by 6.4 per cent and 12 per cent respectively.

Chart 3: Total Volume of Credit Transfers (sent) by Region

- Electronic transfers are the most prevalent method of credit transfers accounting for 98 per cent of total credit transfers (sent) for both value and volume in 2025. This represents €5.6 trillion in value and 486.9 million in volume. Furthermore, nearly 99 per cent of electronic credit transfers for both value and volume are related to online payments.

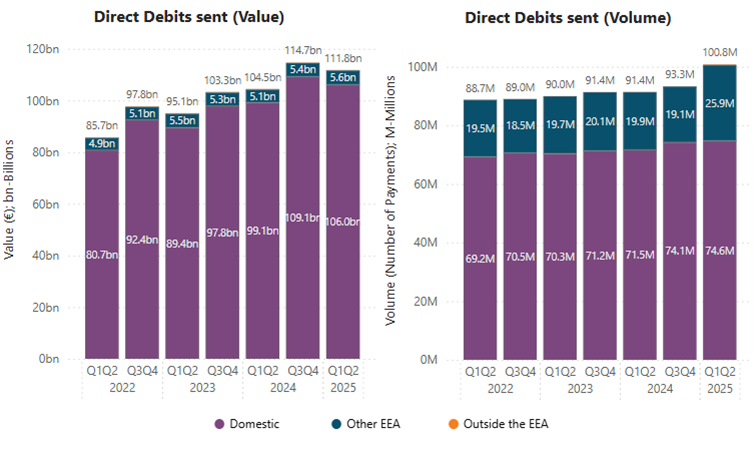

Direct Debits Amount to €111.8 Billion in Q1 & Q2 2025

- Direct debits (sent) remain the second most popular means of payment by value among Irish residents, totalling €111.8 billion in the first half of 2025. The value decreased by 2.4 per cent or €2.9 billion compared with the €114.7 billion recorded in the second half of 2024 (Chart4). The decline is consistent with seasonal trends as direct debits are typically used for recurring payments such as utility bills and subscriptions which peak in value during Q4.

- Despite a decline in value, the volume of direct debits increased by 4.1 per cent, rising from 93.3 million in second half of 2024 to 100.8 million in Q1&Q2 2025.The rise is primarily attributed to a reclassification of payments by a payment service provider to direct debits. Compared with the same period in the previous year (Q1 & Q2 2024), the value of direct debits (sent) increased by 7 per cent (€7.3 billion) and the volume of transactions grew by 10.2 per cent (€9.4 million).

- In value and volume terms, the majority of the direct debits (sent) occurred domestically. In the first half of 2025, domestic direct debits accounted for 94.7 per cent (€106 billion) in value and 74.1 per cent (74.6 million) in volume (Chart4).

Chart 4: Direct Debits Value/Volume (sent)

Usage of Cheques Continues to Decline

- In the first half of 2025, value and volume of cheques (sent) declined by 10.8 per cent to €23 billion and 11.3 per cent to 5.8 million compared to the second half of 2024.

- For Q1-2025 & Q2-2025, value and volume of domestic cheques amounted to 99.2 per cent and 98.5 per cent of total cheques (sent), totalling €22.8 billion and 5.7 million respectively.

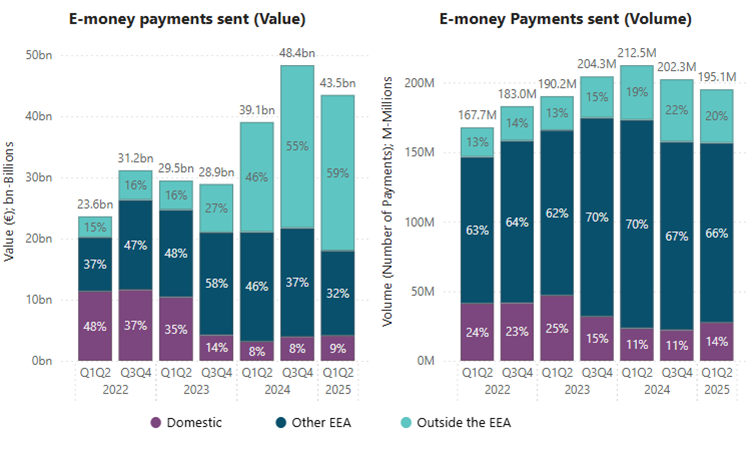

E-Money Payments

- Following a significant increase in the value of e-money payments in 2024, the first half of 2025 experienced a notable 10.1 per cent decline amounting to €43.5 billion from €48.4 billion in second half of 2024. The decrease is mainly attributed to the drop in cross border e-money payments made to other EEA countries.

- The volume (number) of e-money payments also declined slightly by 3.5 per cent to 195.1million in first half of 2025 from 202.3 million in second half of 2024. Compared to the first half of 2024, the volume declined sharply by 8.2 per cent from 212.5 million. Interestingly the corresponding value increased by 11.4 per cent from €39.1 million (Chart 5).

Chart 5: Total Value and Volume of E-money Payments by Region

- E-money Payments(sent) to countries ‘Outside the EEA’ have exhibited a steady growth and constitutes 59 per cent (€25.5 billion) of the total value of e-money payments in the first half of 2025, with majority of these payments made to the United Kingdom. In contrast, the share of e-money payments to ‘Other EEA’ countries declined to 32 per cent of the total value amounting to €13.9 million in the first half of 2025, a notable 21.9 per cent decline from 17.8 million in the second half of 2024.

Card Payments Show Consistent Spending Patterns

- In the first half of 2025, the number of card payments remained steady at 1.6 billion with a marginal 0.8 per cent (12.4 million) decrease compared to the second half of 2024. The corresponding total value of card payments rose by 1.4 per cent to €87.0 billion from €85.7 billion in the second half of 2024.

- Domestic expenditure dominates the card payment ecosystem in Ireland making up 78.1 per cent (1.2 billion) of the total card payments volume, valued at €51.5 billion. This is a 2.9 per cent increase from €50.0 billion in the second half of 2024. Cross border card payments accounted for 12.2 per cent (Other EEA) and 9.7 per cent (Outside the EEA) of volume, amounting to €18.7 billion and €16.8 billion respectively.

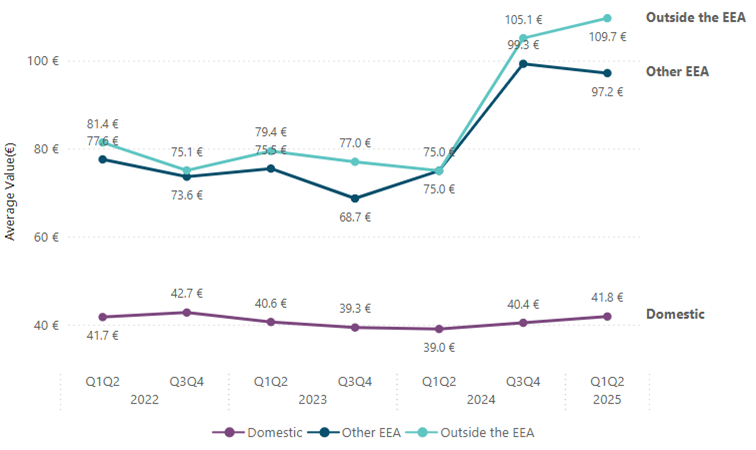

- The average value of cross-border card payments to ‘Other EEA’ and ‘Outside the EEA’ countries increased significantly from the second half of 2024, reaching €97.2 and €109.7 respectively in the first half of 2025. The average domestic card payment value was at €41.8 (Chart 6)

- Card payments that are initiated electronically represent 94.3 per cent of the value and 98.5 per cent of the volume of all card transactions.[i] Within total electronic card payments, online payments show a steady increase, period over period, and constituted 61 per cent at the end of Q2-2025. The growth is spread across regions, becoming increasingly popular in cross-border payments with around 84% of the payments made online.

Chart 6: Average Value of Card Payments by Region

Notes: -

[1] Card-based payment transactions made via computer, mobile internet, and electronic POS terminal (e.g. card machine) are considered to be “initiated electronically, while Card payments authenticated with a signature at the POS, either on paper or on a signature pad, are considered to be card-based payment transactions initiated non-electronically. Other examples of non-electronic card payments are telephone orders and mail orders

Payment Statistics Quarterly | pdf 355 KB

Payment Statistics Quarterly | xlsx 189 KB

Payment Statistics - Annual - Discontinued | xls 868 KB

Explanatory Notes | pdf 251 KB