Pension Fund Statistics

Balance sheet (assets and liabilities) data for pension funds resident in Ireland (ESA 2010 sector S129) consists of financial corporations that principally engage in financial intermediation as a consequence of pooling social risks and providing for income in retirement. In Ireland, a pension fund is an autonomous occupational pension scheme established under trust.

Key Points - Q3 2025

Publication Date: 12 December 2025

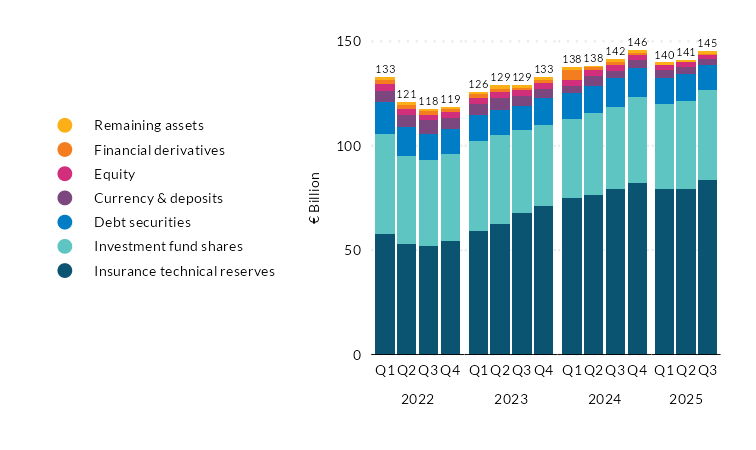

- Total assets of the Irish pension fund (PF) sector increased by 2.8 per cent in Q3 2025 to stand at €145 billion (Chart 1). This was driven by a rise in insurance technical reserves of 4.9 per cent and investment fund shares of 3.2 per cent. This growth was partially offset by a fall in holdings of currency & deposits and debt securities.

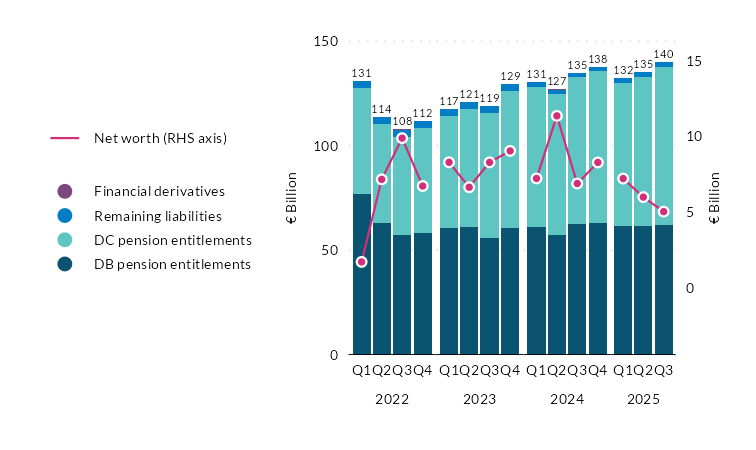

- Pension entitlements increased by 3.7 per cent in Q3 2025 to stand at €138 billion (Chart 2). This was driven by an increase in defined contribution (DC) pension entitlements, which rose by 6 per cent relative to the previous quarter. Defined benefit (DB) 1 pension entitlements also increased albeit at a slower rate (+0.9%).

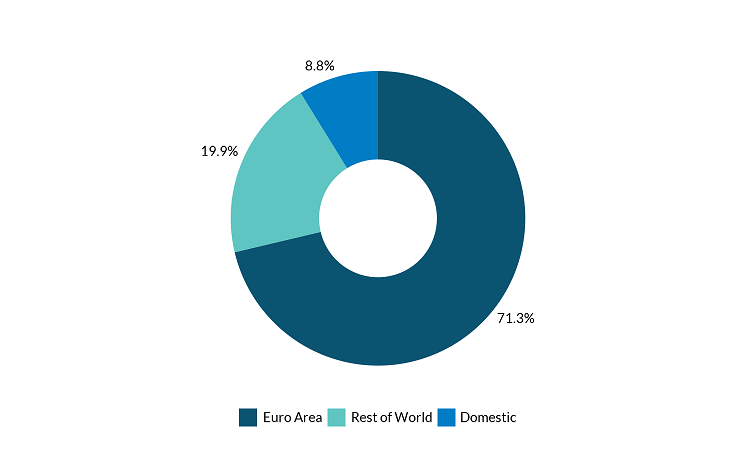

- At end of Q3 2025, pension fund holdings of debt securities accounted for €12.1 billion, or 8.4 per cent of total assets. These assets were predominantly made up of issuances from euro area countries (excluding Ireland), which accounted for €8.6 billion or 71 per cent.

Summary Charts

Chart 1: Assets of Irish pension funds

View data for chart 1

View data for chart 1

Chart 2: Liabilities of Irish pension funds

View data for chart 2

View data for chart 2

Chart 3: Debt securities assets of Irish pension funds by area (% share) – Q3 2025

View data for chart 3

Notes

[1] Defined benefit technical reserves includes hybrid schemes. Technical reserves are valued on an accounting standard basis. Defined benefit technical reserves and net worth are reported on an annual basis (at year end), values for other quarters are estimated and subject to revision on receipt of latest annual data.

Explanatory Notes Pension Fund Statistics | pdf 259 KB

Pension Fund Statistics | xls 37 KB