Household Wealth

This quarterly report on the wealth of Irish households complements the statistical releases for Irish Quarterly Financial Accounts with more detail on households' assets and liabilities and a breakdown by wealth distribution.

Key Points – Q3 2025

Publication date: 26 February 2026

- The net wealth of Irish households reached €1,336.8bn at the end of Q3 2025, increasing by €48.3bn since the previous quarter.

- Total household investment of €10.4bn was mainly driven by investment in currency and deposits and new housing assets.

- The total value of housing assets owned by Irish households increased by €31.1bn since the previous quarter, largely due to positive revaluations.

- As of Q3 2025, the wealthiest 10 per cent of households held 49.2 per cent of total net wealth in the country.

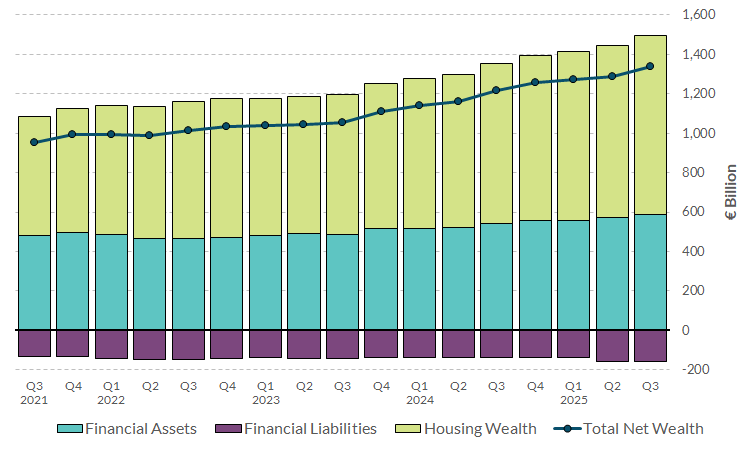

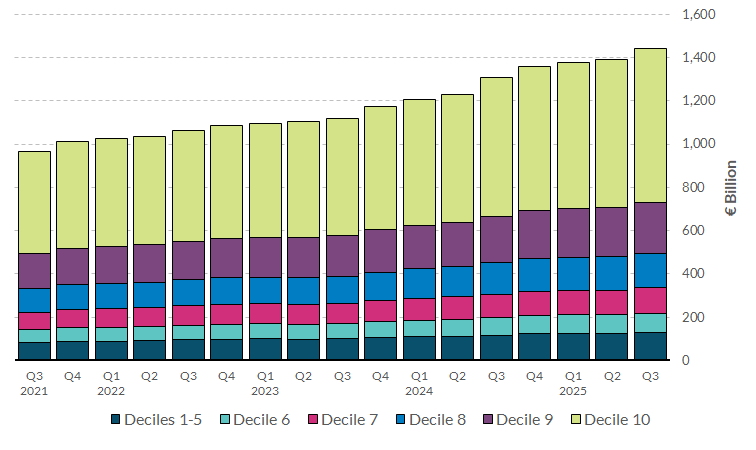

Chart 1 – Total net wealth of Irish households

View data for chart 1 (XLSX 20.98KB)

Total net wealth of Irish households rose by €48.3bn to stand at €1,336.8bn in Q3 2025. This represents a new series high, continuing the pattern of growth seen in recent years.

The overall increase in net wealth was driven by a rise in housing wealth, which increased by €31.1bn. Housing wealth accounts for 67.7 per cent of total net wealth and 60.6 per cent of the total assets of Irish households.

Households’ financial assets stood at €589.0bn at the end of Q3 2025 and were mainly composed of currency and deposits (€218.6bn) and insurance and pension entitlements (€272.0bn).

Total liabilities, mainly consisting of long-term loans, totalled €157.1bn. This amount increased by €1.1bn from the end of the previous quarter.

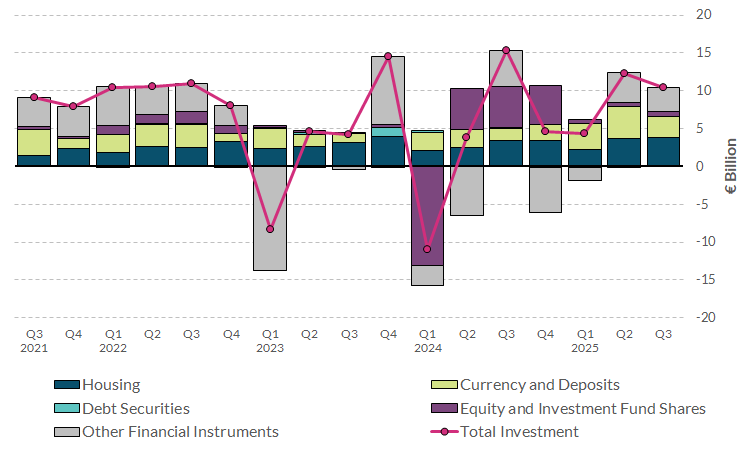

Chart 2 – Quarterly investment of Irish households, by instrument

View data for chart 2 (XLSX 14.79KB)

Households’ total investment in new housing and financial assets totalled €10.4bn in Q3 2025. Of this, investment in new housing equalled €3.8bn, which is €0.1bn higher than in the previous quarter. Financial investments were primarily in currency and deposits (€2.8bn), and in other financial instruments (€3.2bn). The latter include investment in pension entitlements of €1.9bn.

In recent years, Irish households have generally displayed positive quarterly investment in housing and financial instruments.

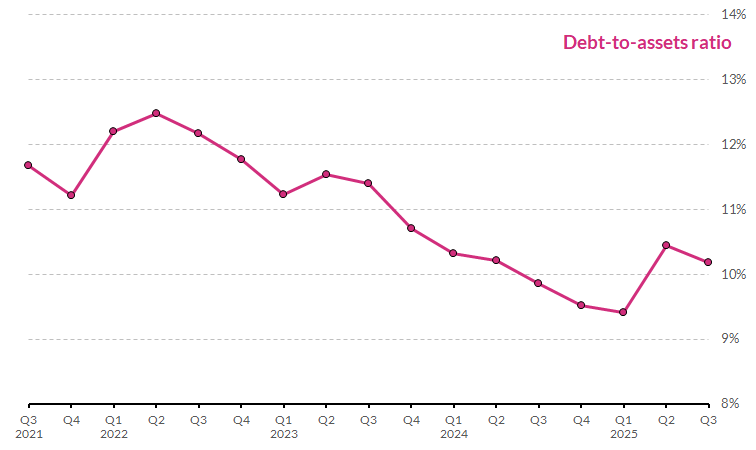

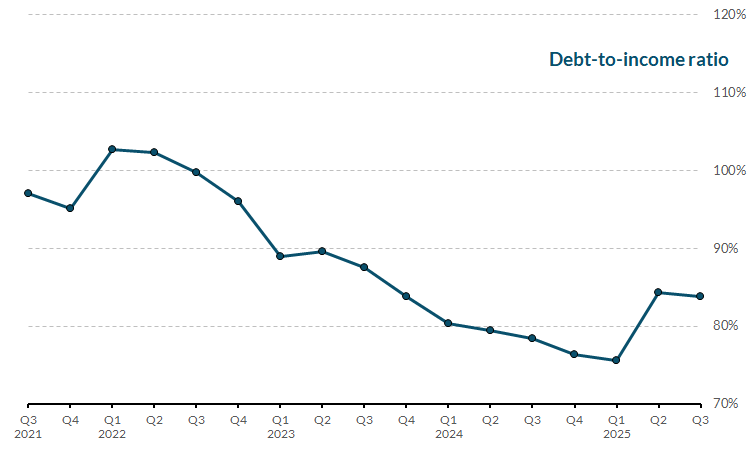

Chart 3 – Household leverage indicators

View data for chart 3 (XLSX 21.93KB)

Total household assets increased by €49.4bn over the course of the quarter. Given the smaller increase in household loans, which grew by €1.2bn to reach €152.1bn at the end of Q3 2025, the debt-to-assets ratio of Irish households declined to 10.2 per cent.

The debt-to-income ratio of Irish households also decreased to reach 83.8 per cent at the end of the quarter. Data from the Central Statistics Office (CSO) shows that household gross disposable income (on an annualised basis) equalled €181.5bn as of Q3 2025.

Chart 4 – Total net wealth of Irish households, by wealth decile

View data for Chart 4 (XLSX 31.89KB)

Distributional Wealth Accounts (DWA) data provide insights on the distribution of wealth across Irish households.

As of Q3 2025, the wealthiest 10 per cent of Irish households owned €709.3bn, or 49.2 per cent of total household net wealth in the country.

The total net wealth of households in the poorest half of the distribution increased by €4.8bn (3.9 per cent) to stand at €128.2bn, or 8.9 per cent of the national total. The increase was mainly due to housing assets’ growth.

As of Q3 2025, the richest 10 per cent of Irish households held more than five times the amount held by households in the bottom half of the net wealth distribution altogether.

Households in the “middle” part of the distribution (i.e., those in deciles 6 to 9) owned €604.1bn overall, or 41.9 per cent of total net wealth in the country at quarter-end.

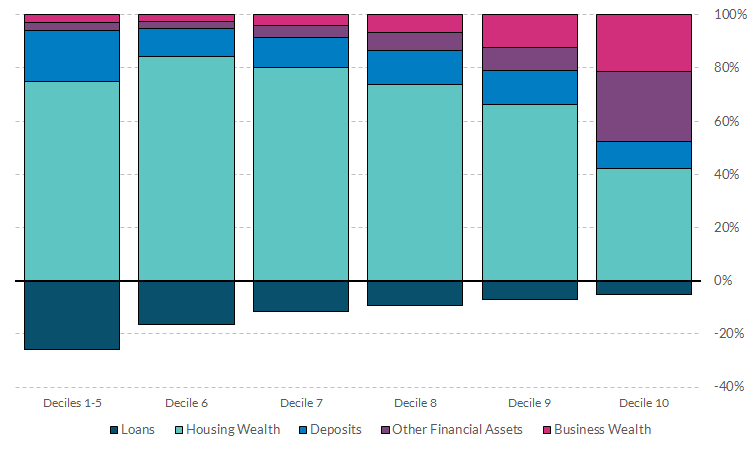

Chart 5 – Balance sheet composition of Irish households, by wealth decile

View data for chart 5 (XLSX 25.81KB)

The balance sheet composition of Irish households differs significantly between the wealthier and poorer.

Overall, as of Q3 2025, households in the top net wealth decile displayed a more diversified portfolio composition. In particular, other financial assets (i.e., debt securities, listed shares, investment fund shares, and life insurance and annuity entitlements) featured prominently, accounting for 26.2 per cent of total assets. Wealthier households also displayed lower leverage (5.3 per cent), when compared to households in the bottom half of the wealth distribution.

Conversely, poorer households held the largest part of their financial wealth in deposits (19.2 per cent of their total assets) and were significantly more leveraged (25.9 per cent).

For all household groups, housing assets represent the main component of their wealth.

The balance sheet composition of households in each wealth decile remained almost unchanged from the previous quarter. Since the beginning of the series, these proportions have been generally stable over time.

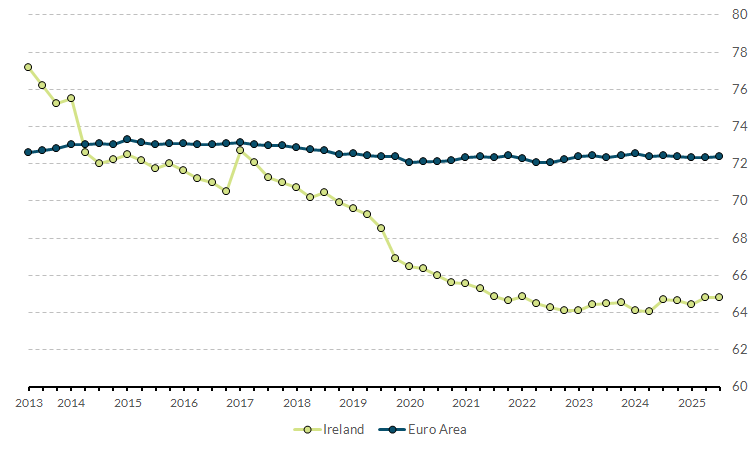

Chart 6 – Gini coefficient of wealth inequality

View data for chart 6 (XLSX 19.86KB)

As of Q3 2025, the Irish Gini coefficient (a widely used measurement of wealth inequality) was 64.8.

This remained well below the value of the same index for the euro area as a whole (72.4) and of most other European countries, as it has been for the past years. Moreover, since the beginning of the series, the Gini coefficient for Ireland decreased significantly (-12.4 points), indicating a notable reduction in the level of wealth inequality in the country.

The sustained de-leveraging process of poorer households and the rise in value of housing assets over the years – which mainly benefited households for whom this asset represents a larger component of their total wealth (i.e., mid-lower deciles) – drove the increase in the share of total net wealth held by the poorest half of households. As a result, net wealth inequality in Ireland significantly decreased since the beginning of the series.

Documents

Household Wealth Report - 2025 Q3 | pdf 468 KB

Household Wealth Report - Glossary | pdf 424 KB

Household Wealth Report - Publication Notes | pdf 246 KB