Short-term credit

This is a transcript of text in the video titled “What does buying goods and services on credit mean

for me?”

Have you ever bought something in-store or online using short-term credit?

This can mean paying in full later or by instalments over a short period of time.

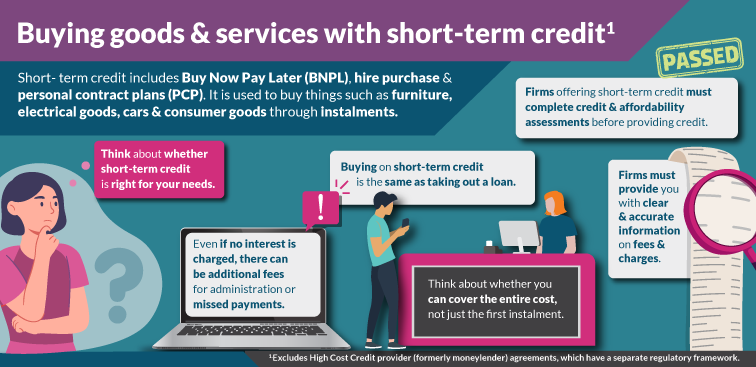

Buying things in this way is the same as using a loan, even when no interest is charged.

You might be offered a form of credit in department stores, car dealerships or online to pay for

goods and services.

Examples include hire-purchase, personal contract plans, consumer hire and buy now pay later.

Regardless of what you are buying, you should think about whether these types of credit are right

for your needs.

These credit agreements can include additional fees for administration or missed payments.

And if the loan is for €500 or more, the credit provider must submit this information to the

Central Credit Register.

Central Bank of Ireland is now regulating short-term credit.

Firms must ensure that any credit offered to you is suitable for your needs.

They must also provide you with information to make an informed choice.

Buying on credit is when you purchase goods or services now and pay for them in full later or by instalments over a short period of time. Traditionally this was often referred to as“buying on tick” or the “never never”.

Examples of short-term credit services, which are now regulated by Central Bank of Ireland, include hire-purchase, personal contract plans, consumer hire, in-store credit and buy now, pay later.

It is common to see this type of payment offered when you are shopping online, or through ads in store, which offer you the option to pay in full or via instalments.

Do you buy anything using short-term credit?

We asked members of the public if they buy goods or services using short-term credit. Their responses highlight the importance of affordability – regardless of whether you pay for something now or later.

This is a transcript of text in the video titled "Do you buy anything using short term credit?"

Participant 1: I like paying for things with money I've got rather than kind of relying on credit.

Participant 2: Normally, now if I was to buy something, I kind of more or less save for it rather

than running up bills as such.

Participant 3: No, if I can't afford something, I’m not buying it.

Participant 4: I just don't do credit. I just like to buy something and it's paid for and that's it.

Participant 5: Well, that just costs more in the long run so, living beyond my means.

Participant 6: I like to pay for it as I buy it. I buy it when I can afford it.

Participant 7: I just like to pay for cash for things when I have it.

Short-term credit has become increasingly popular with consumers in recent years to buy goods and services, such as cars, furniture, electrical and consumer goods. Our research has found that one in four people are likely to consider using it to pay.

While you might see it as an easy way to pay for goods and services, it is a form of credit. You should be aware of the potential consequences of this, especially if you miss a payment.

Consumer Research Bulletin - Buy Now Pay Later | pdf 742 KB

Buying goods and services on credit is the same as taking out a loan

If you are thinking about using short-term credit to buy a good or service, it is important to consider whether this is right for your needs. For example:

- Before you choose to buy something using short-term credit, think about whether your budget will cover all the repayments throughout the repayment period.

- Buying things using short-term credit is the same as taking out a loan, even when no interest is charged. You will still have to repay the credit you have borrowed. You will also have to complete a credit assessment and agree a repayment plan with the credit provider. If you miss a repayment, it may affect your ability to borrow in the future.

When you buy using short-term credit, the credit provider will have to explain costs to you. Short-term credit agreements can include additional fees and charges. For example, if you miss a payment, you will have to pay late payment fees, which could significantly increase your instalment cost and total cost of credit. Set-up or administration fees are also common.

It is important that you understand the fees that you could be charged, as this could significantly increase the price you will pay for goods and services. It could also have longer-term implications for your ability to borrow in the future.

If the loan is for €500 or more, the credit provider must submit this information to the Central Credit Register.

New legislation means that hire-purchase, PCPs, consumer hire and indirect credit agreements (e.g. BNPL) are now regulated activities, and firms providing them must be authorised by the Central Bank.

This also means these firms have to follow certain rules, including specific parts of the Consumer Protection Code 2012.

These rules require firms to complete creditworthiness and affordability assessments in advance of granting credit to a consumer. These assessments aim to protect consumers from getting into too much debt.

Firms are also required to meet requirements in relation to advertising, to ensure that advertisements are clear, fair, accurate and do not mislead.

Credit providers must also comply with the Minimum Competency Code 2017 and the Minimum Competency Regulations 2017, which set out minimum professional standards for persons providing certain financial services, particularly when dealing with consumers.

See also: