Consumer Protection Code and Regulations

Notice I Consumer Protection Code 2025

Central Bank of Ireland published a revised Consumer Protection Code on 24 March 2025.

The revised Code will take effect on 24 March 2026 following a 12-month implementation period.

Until then, the existing Consumer Protection Code 2012 (as detailed on this page) continues to apply to regulated firms, and the protections that are currently in place remain effective.

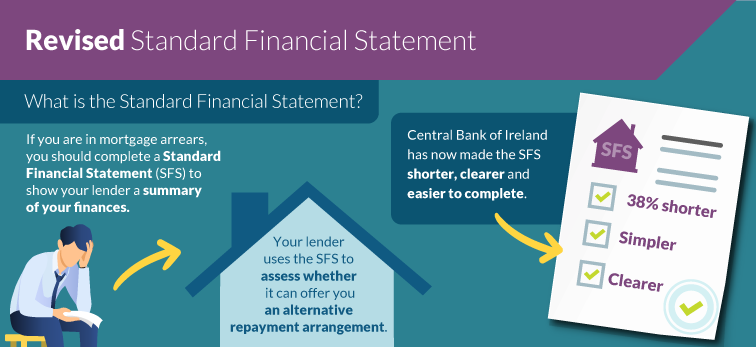

Revised Standard Financial Statement

On 27 July 2021, a revised version of the Standard Financial Statement (SFS) was published through an Addendum to the Code of Conduct on Mortgage Arrears 2013 (PDF 571.24KB) and an Addendum to the Consumer Protection Code 2012 (PDF 564.22KB).

The revised SFS is effective from 1 January 2022. A new Consumer Guide to completing the SFS (PDF 1.03MB) has also been published.

Updated Consumer Protection Code 2012 Guidance

Following the introduction of the new provisions which came into effect in March 2020 and aim to ensure transparency of commission arrangements and independence of intermediaries, the Central Bank has published an updated Consumer Protection Code Guidance document (PDF 1.06MB).

The Central Bank of Ireland has a number of statutory codes of conduct. These codes of conduct are set out below.

Explore more industry codes, including corporate governance requirements.

Unofficial Consolidation of the Consumer Protection Code 2012 (the Unofficial Consolidation of the 2012 Code)

The Consumer Protection Code 2012 (the 2012 Code) has been amended via seven addenda. For ease of access, the Central Bank has produced the Unofficial Consolidation of the 2012 Code to make the 2012 Code and its seven addenda available in one document. This document makes no other changes other than the consolidation and is intended to be of assistance to all users. The Unofficial Consolidation of the 2012 Code was first published in January 2020, and updated on 31 March 2020 when the enhanced consumer protection measures for Intermediary Inducements took effect.

Please note that the document is an unofficial consolidation of the 2012 Code, as it stood revised from 1 January 2015. The document has been prepared by the Central Bank for ease of reference only and is not a legal document.

While every care has been taken in the preparation of the Unofficial Consolidation of the 2012 Code, the Central Bank can assume no responsibility for and give no guarantees, undertaking or warranties concerning its accuracy, completeness or up to date nature of the information provided and does not accept any liability whatsoever arising from any errors or omissions. The document is not legal advice and at all times the official text remains as published in the 2012 Code, as amended, including in its various addenda.

Unofficial Consolidation of the Consumer Protection Code | pdf 1713 KB

Consumer Protection Code

The Consumer Protection Code 2012

The Consumer Protection Code 2006 was revised and the Consumer Protection Code 2012 (the 2012 Code) came into effect on 1 January 2012.

On 1 January 2015, the 2012 Code was amended by the insertion of Chapter 13 which introduced additional requirements for Debt Management firms.

In July 2015, following the enactment of the Consumer Protection (Regulation of Credit Servicing Firms) act 2015, we produced an Addendum to the Consumer Protection Code 2012.

In July 2016, following a public consultation process on Increased Protections for Variable Rate Mortgage Holders (CP98), and to give effect to consequential amendments to the Consumer Protection Code arising from the transposition of the EU Mortgage Credit Directive and the coming into effect of the Central Bank (Supervision and Enforcement) Act 2013 (Section 48) (Lending to Small and Medium-Sized Enterprises) Regulations 2015, we produced a further Addendum to the Consumer Protection Code 2012.

In August 2017, to give effect to consequential amendments to the Consumer Protection Code arising from the transposition of the Markets in Financial Instruments Directive II (MiFID II), we produced a further Addendum to the Consumer Protection Code 2012.

Article 3 of Directive 2014/65/EU (MiFID II) contains a Member State discretion, which has been exercised by the Minister for Finance. This allows certain firms to continue to be regulated under the Investment Intermediaries Act 1995 rather than the European Union (Markets in Financial Instruments) Regulations 2017 (the MiFID Regulations 2017), provided they are subject to certain requirements that are analogous to requirements imposed on investment firms regulated under the MiFID Regulations 2017. The amendments to the Code were required in order to apply these additional requirements to retail investment intermediaries that avail of the exemption from authorisation under the MiFID Regulations 2017.

In November 2017 the Central Bank produced an Addendum to the Consumer Protection Code 2012 under Section 117 of the Central Bank Act 1989 to give effect to consequential amendments arising from:

- The transposition of Directive 2014/92/EU of the European Parliament and of the Council of 23 July 2014 on the comparability of fees related to payment accounts, payment account switching and access to payment accounts with basic features (the Payment Accounts Directive) into Irish law; and

- The application, from 1 January 2018, of Regulation (EU) No 1286/2014 of the European Parliament and of the Council of 26 November 2014 on key information documents for packaged retail and insurance-based investment products (the PRIIPs Regulation).

Part 1 of the Code Addendum, which provides for a consequential amendment due to the transposition of the Payment Accounts Directive, is to take effect immediately.

The consequential amendments to the Consumer Protection Code 2012 arising from the application of the PRIIPs Regulation are set out in Part 2 of the Code Addendum. These amendments apply from 1 January 2018.

In May 2018, the Central Bank produced an Addendum to the Consumer Protection Code 2012 under Section 117 of the Central Bank Act 1989 to give effect to consequential amendments arising from:

- The transposition of Directive 2015/2366/EU of the European Parliament and of the Council of 25 November 2014 on payment services in the internal market into Irish law via the European Union (Payment Services) Regulations 2018, S.I. No. 6 of 2018 (the Payment Services Regulations).

The consequential amendments to the Consumer Protection Code 2012 arising from the application of the Payment Services Regulations are set out in the Code Addendum. These amendments apply from 23 May 2018.

In June 2018, following a public consultation process on Enhanced Mortgage Measures: Transparency and Switching (CP112), the Central Bank produced a further Addendum to the Consumer Protection Code 2012. These amendments apply from 1 January 2019.

In September 2019, the Central Bank produced a further Addendum to the Consumer Protection Code 2012 (the Code). Part 1 of this Addendum sets out amendments to the Code following a public consultation on Intermediary Inducements – Enhanced Consumer Protection Measures (CP116). These amendments apply from 31 March 2020. Part 2 of this Addendum was produced to give effect to consequential amendments to the Code arising from the transposition of the Insurance Distribution Directive (IDD), and takes immediate effect.

In September 2024, the Central Bank published an Addendum to the Consumer Protection Code 2012 following the introduction of the European Union (Credit Servicers and Credit Purchasers) Regulations 2023.

In December 2024 the Central Bank published an Addendum to the Consumer Protection Code 2012 (the Code) following the introduction of the Regulation (EU) 2023/1114 of the European Parliament and of the Council of 31 May 2023 on markets in crypto-assets. Markets in Crypto-Assets Regulation (MiCAR) brings issuers of crypto–assets and service providers within the regulatory perimeter. The Code applies to issuers of Asset Reference Tokens (ARTs), issuers of E-Money Tokens (EMTs), issuers of other crypto-assets that fall within the MiCAR regulatory framework, and to Crypto-Asset Service Providers (CASPs). The Code applies in full, except for instances where there is an overlap with an equivalent requirement contained in MiCAR or where a provision is not relevant due to the nature of the business model of the firm.

Consumer Protection Code 2012 documents

Addendum to the Consumer Protection Code 2012 – December 2024 | pdf 724 KB

Addendum to the Consumer Protection Code 2012 - September 2024 | pdf 370 KB

Addendum to the Consumer Protection Code 2012 - May 2022 | pdf 738 KB

Addendum to the Consumer Protection Code 2012 - January 2022 | pdf 133 KB

Addendum to the Consumer Protection Code 2012 - July 2021 | pdf 577 KB

Addendum to the Consumer Protection Code 2012 - September 2019 | pdf 1178 KB

Addendum to Consumer Protection Code 2012 - June 2018 | pdf 477 KB

Addendum to Consumer Protection Code 2012 - May 2018 | pdf 321 KB

Addendum to Consumer Protection Code 2012 - December 2017 | pdf 337 KB

Addendum to Consumer Protection 2012 Code - August 2017 | pdf 563 KB

Addendum to Consumer Protection Code 2012- July 2016 | pdf 728 KB

Feedback to CP98 - Increased Protections for Variable Rate Mortgage Holders | pdf 837 KB

Addendum to Consumer Protection Code 2012- July 2015 | pdf 651 KB

Consumer Protection Code 2012 | pdf 1565 KB

Letter issued to debt management firms re Additional Consumer Protection Requirements | pdf 245 KB

Consumer Protection Code 2012 1 January 2012 to 31 December 2014 | pdf 1389 KB

Guidance on the Advertising Requirements of the Consumer Protection Code 2012 | pdf 1157 KB

Letter issued to regulated entities re Consumer Protection Code 2012 dated October 2011 | pdf 68 KB

Consumer Protection Code 2012 Guidance - Updated May 2021 | pdf 1116 KB

Feedback to CP54-Review of the Consumer Protection Code - Dated 2011 | pdf 1086 KB

April 2012 - Consumer Protection Code 2012 and Code of Conduct on Mortgage Arrears Interpretations | pdf 146 KB

Insurance Requirements Regulations 2022

On 15 March 2022, the Central Bank published the Central Bank (Supervision and Enforcement) Act 2013 (Section 48(1)) (Insurance Requirements) Regulations 2022 which will apply to insurance undertakings and insurance intermediaries from 1 July 2022.

Insurance Regulations Requirements 2022 | pdf 173 KB

Insurance Regulations 2022 - Q&A (updated 6 May 2022) | pdf 510 KB

The Consumer Protection Code 2006

The Consumer Protection Code 2006 (the Code) was introduced in August 2006 and it came fully into effect on 1 July 2007. The Code set out the requirements that regulated firms must comply with when dealing with consumers in order to ensure a similar level of protection for consumers, regardless of the type of financial services provider.

In May 2008, we produced an Addendum to the Consumer Protection Code in respect of the activities of retail credit firms and home reversion firms, to meet our new regulatory responsibilities in respect of these firms as set out in the Markets in Financial Instruments & Miscellaneous Provisions Act, 2007.

Consumer Protection Code 2006 documents

Consumer Protection Code 2006 | pdf 2344 KB

Consumer Protection Code Clarifications Document July 2007 | pdf 209 KB

Consumer Protection Code Regulatory Impact Analysis | pdf 653 KB

CP10 - Public Response to CP10 Consumer Protection Code | pdf 1898 KB

Letter re: Clarification on Provision 4.14 of the Consumer Protection Code 19 November 2007 | pdf 45 KB

Letter to industry regarding implementation date of 1 July 2007 set for Consumer Protection Code 2006 dated 27 April 2007 | pdf 44 KB

Addendum to the 2006 Consumer Protection Code Dated May 2008 | pdf 180 KB

Letter issued to industry regarding the Addendum to the Consumer Protection Code dated 23 May 2008 | pdf 37 KB

Notice to creditors of the dis-application of provisions of the Consumer Protection Code in view of the EC (Consumer Credit Agreements) Regulations 2010 dated 2 February 2011. | pdf 401 KB

Consumer Protection Code for Licensed Moneylenders

As licensed moneylenders are not subject to the Consumer Protection Code, the Central Bank of Ireland has a code specifically for licensed moneylenders.

The Central Bank (Supervision and Enforcement) Act 2013 (Section 48) (Licensed Moneylenders) Regulations 2020 will replace the General Principles of the Consumer Protection Code for Licensed Moneylenders from 1 January 2021. However, Regulation 8(4) will come into effect earlier on 1 September 2020.

Code of Conduct on Mortgage Arrears

In February 2009, a Code of Conduct on Mortgage Arrears was introduced for all mortgage lenders. This Code was effective from 27 February 2009 to 16 February 2010. On 17 February 2010, an amended Code of Conduct on Mortgage Arrears was introduced for all mortgage lenders. This Code was effective from 17 February 2010 to 31 December 2010. On 1 January 2011, a revised Code of Conduct on Mortgage Arrears came into effect. On 1 July 2013, a further revised Code of Conduct on Mortgage Arrears came into effect.

The Central Bank issued a letter to industry on 22 March 2019 setting out the Central Bank's expectation that regulated entities provide each borrower with fuller information on the assessment of his/her mortgage arrears case and the reasons why alternative repayment arrangements considered, but not offered to the borrower, are not appropriate and not sustainable for the borrower's individual circumstances. Regulated entities must provide this additional information to borrowers as soon as possible, and no later than from 1 January 2020. While the provision of this information does not apply retrospectively, regulated entities should act in the best interests of consumers and facilitate requests for this information from such borrowers.

In September 2024, the Central Bank published an Addendum to the Code of Conduct on Mortgage Arrears 2013 following the introduction of the European Union (Credit Servicers and Credit Purchasers) Regulations 2023.

All documents relevant to the Code of Conduct on Mortgage Arrears and its implementation are set out below.

Appropriate and Sustainable Alternative Repayment Arrangements – July 2025 | pdf 418 KB

Addendum to the Code of Conduct on Mortgage Arrears 2013 - September 2024 | pdf 213 KB

Addendum to the Code of Conduct on Mortgage Arrears 2013 - July 2021 | pdf 584 KB

Dear CEO Letter - Publication of revised Standard Financial Statements published 27 July 2021 | pdf 82 KB

Letter issued to regulated entities re Code of Conduct on Mortgage Arrears 22 March 2019 | pdf 129 KB

Addendum to the Code of Conduct on Mortgage Arrears 2013 | pdf 700 KB

2013 Code of Conduct on Mortgage Arrears | pdf 1127 KB

Letter issued to regulated entities on the 2013 Code of Conduct on Mortgage Arrears | pdf 851 KB

Feedback Statement CP63 - Review of the Code of Conduct on Mortgage Arrears | pdf 890 KB

Code of Conduct on Mortgage Arrears 27 February 2009 to 16 February 2010 | pdf 392 KB

Letter re introduction of Code of Conduct on Mortgage Arrears 19 February 2009 | pdf 31 KB

Code of Conduct on Mortgage Arrears 17 February 2010 to 31 December 2010 | pdf 204 KB

Letter re amendment to Code of Conduct on Mortgage Arrears 5 February 2010 | pdf 292 KB

2011 Code of Conduct on Mortgage Arrears | pdf 791 KB

Letter re revised Code of Conduct on Mortgage Arrears 6 December 2010 | pdf 46 KB

April 2012 - Consumer Protection Code 2012 and Code of Conduct on Mortgage Arrears Interpretations | pdf 145 KB

December 2012 - Clarifications on the Code of Conduct on Mortgage Arrears | pdf 259 KB

Thematic Review on the Ongoing Suitability of Long-Term Life Assurance Products

On 4 August 2023, the Central Bank of Ireland issued an Industry letter to financial services providers regarding the Central Bank's expectations of firms in respect of the ongoing suitability of long-term life assurance products.

Dear CEO - Thematic Review on the Ongoing Suitability of Long-Term Life Assurance Products | pdf 153 KB

Central Bank expectations relating to the risk posed to consumers of not having sufficient home insurance cover

On 23 September 2022, the Central Bank of Ireland issued a letter to industry on its expectations relating to the risk posed to consumers of not having sufficient home insurance cover.

Dear CEO - Central Bank expectations relating to the risk posed to consumers of not having sufficient home insurance cover | pdf 111 KB

The following provisions of the 2006 Consumer Protection Code (2006 Code) were dis-applied for mortgage lenders when dealing with mortgage arrears and pre-arrears cases under the CCMA:

- Chapter 2: Provision 46, 47 and 48 (Complaints handling)

- Chapter 4: Provisions 4 and 11.

On 1 January 2012, the Consumer Protection Code 2012 (2012 Code) became effective, replacing the 2006 Code. With effect from that date, the following provisions of the 2012 Code have been dis-applied for mortgage lenders dealing with borrowers in arrears or pre-arrears under the CCMA:

- Chapter 6 (Post-sale information requirements): Provisions 6.8 and 6.9

- Chapter 8 (Arrears handling): All provisions

Report on the Effectiveness of the CCMA in the context of the Sale of Loans by Regulated Lenders

In November 2018, the Central Bank of Ireland published the Report on the Effectiveness of the Code of Conduct on Mortgage Arrears in the context of the sale of loans by regulated lenders. The report finds the Code is working effectively and as intended where borrowers engage with the process.

View Consumer Explainer and Infographic on CCMA.

Report on the Effectiveness of the CCMA in the context of the Sale of Loans by Regulated Lenders | pdf 1158 KB

Consumer Protection expectations as a result of the withdrawal of retails banks from the Irish market

On the 28th July 2022, the Central Bank of Ireland issued an industry letter regarding its' consumer protection expectations as a result of the withdrawal of retails banks from the Irish market.

Dear CEO - Consumer Protection expectations as a result of the withdrawal of retails banks from the Irish market | pdf 104 KB

Consumer Protection expectations in a changing retail banking landscape 2021

On 25 June 2021, the Central Bank of Ireland issued an Industry letter regarding its’ consumer protection expectations in a changing retail banking landscape.

Dear CEO - Withdrawal of retail banks from the Irish market | pdf 54 KB

Dear CEO - Invitation to roundtable meeting on retail banking exits and account migrations | pdf 187 KB

Consumer Protection Expectations in a Changing Retail Banking Landscape 2021 | pdf 290 KB

Expectations of firms in respect of sales, securitisations, purchases and transfers of residential mortgage loans

On 20 August 2019, the Central Bank of Ireland issued an Industry letter to Credit Institutions, Credit Servicing Firms and Retail Credit Firms regarding the Central Bank's expectations of firms in respect of sales, securitisations, purchases and transfers of residential mortgage loans.

Industry letter issued to Credit Institutions - Central Bank’s expectations of firms in respect of sales, securitisations, purchases and transfers of residential mortgage loans | pdf 134 KB

Industry letter issued to Credit Servicing Firms - Central Bank’s expectations of firms in respect of sales, securitisations, purchases and transfers of residential mortgage loans | pdf 134 KB

Industry letter issued to Retail Credit Firms - Central Bank’s expectations of firms in respect of sales, securitisations, purchases and transfers of residential mortgage loans | pdf 134 KB

Charging of costs associated with the legal process and other third party charges to borrowers in mortgage arrears

On 23 October 2019, the Central Bank of Ireland issued an industry letter to Credit Institutions, Credit Servicing Firms and Retail Credit Firms regarding charging of costs associated with the legal process and other third party charges to borrowers in mortgage arrears.

Industry letter issued to Credit Institutions on charging costs with the legal process and other third party charges to borrowers in mortgage arrears | pdf 270 KB

Industry letter issued to Credit Servicing Firms on charging costs with the legal process and other third party charges to borrowers in mortgage arrears | pdf 269 KB

Industry letter issued to Retail Credit Firms on charging costs with the legal process and other third party charges to borrowers in mortgage arrears | pdf 269 KB

Standard Financial Statement

The purpose of the Standard Financial Statement (SFS) is to gather relevant financial information from a borrower in arrears or pre-arrears. The SFS is essential to the effectiveness of the Mortgage Arrears Resolution Process and the revised format will ensure that assessments of individual borrowers’ cases will be based on a common analysis of their financial circumstances.

Guide to Completing a Standard Financial Statement | pdf 1056 KB

Standard Financial Statement | pdf 435 KB

On 27 July 2021, a revised version of the SFS was published through an Addendum to the Code of Conduct on Mortgage Arrears 2013 and an Addendum to the Consumer Protection Code 2012.

The revised SFS is effective from 1 January 2022. A new Consumer Guide to completing the SFS, as well as a helpful Infographic, have also been published.

Business Lending to Small and Medium Enterprises (SMEs)

In February 2009, a code of conduct for all business lending by regulated entities, excluding credit unions, was introduced.

This was revised in 2011 and the Code of Conduct for Business Lending to Small and Medium Enterprises 2012 (the SME Code) came into effect on 1 January 2012.

On 18 December 2015, the Central Bank (Supervision and Enforcement) Act 2013 (Section 48) (Lending to Small and Medium-Sized Enterprises) Regulations 2015 were published. On 2 June 2016, the Central Bank (Supervision and Enforcement) Act 2013 (Section 48) (Lending to Small and Medium-Sized Enterprises) (Amendment) Regulations 2016 were published. These Regulations came into effect, and replaced the existing SME Code, from 1 July 2016 for regulated lenders, except for credit unions, for whom the SME Regulations came into effect on 1 January 2017.

On 25 January 2018, further technical amendments to the Regulations were published concerning the definitions of SMEs. These Amendment Regulations took effect immediately.

For ease of reference, the Central Bank of Ireland has prepared an unofficial consolidation of the Central Bank (Supervision and Enforcement) Act 2013 (Section 48) (Lending to Small and Medium-Sized Enterprises) Regulations 2015 (S.I. No. 585 of 2015), as amended by the 2016 and 2018 Regulations Please note that this is not a legal document.

Central Bank (Supervision and Enforcement) Act 2013 (Section 48) (Lending to Small and Medium-Sized Enterprises) (Amendment) Regulations 2018 - SI No. 18 of 2018 | pdf 356 KB

Central Bank (Supervision and Enforcement) Act 2013 (Section 48) (Lending to Small and small and Medium-Sized Enterprises) Regulations 2015 - Unofficial Consolidation | pdf 669 KB

Central Bank (Supervision and Enforcement) Act 2013 (Section 48) (Lending to Small and Small and Medium-Sized Enterprises) (Amendment) Regulations 2016 | pdf 41 KB

Central Bank (Supervision and Enforcement) Act 2013 (Section 48) (Lending to Small and Medium-Sized Enterprises) Regulations 2015 | pdf 332 KB

A Guide for Micro and Small Enterprises and Guarantors 2016 | pdf 763 KB

Feedback Statement to CP91- Review of the Code of Conduct for Business Lending to SMEs | pdf 1059 KB

Addendum to Code of Conduct for Business Lending to Small and Medium Enterprises 2012 | pdf 646 KB

Code of Conduct for Business Lending to Small and Medium Enterprises 2012 | pdf 520 KB

Code of Conduct for Business Lending to Small and Medium Enterprises 2009 | pdf 63 KB

Letter re introduction of Code of Conduct for Business Lending to Small and Medium Enterprises 9 March 2009 | pdf 237 KB

Code of Conduct on the Switching of Payment Accounts with Payment Service Providers

On 1 October 2010 a Code of Conduct on the Switching of Current Accounts with Credit Institutions was introduced and came into effect on that date.

This code was revised in 2016 following transposition of the EU Payment Accounts Directive, and the "Code of Conduct on the Switching of Payment Accounts with Payment Service Providers" came into effect on 21 September 2016.

2016 Code of Conduct on the Switching of Payment Accounts with Payment Service Providers | pdf 725 KB

Code of Conduct on the Switching of Current Accounts with Credit Institutions | pdf 285 KB

Discretionary Commission Arrangements in motor finance arranged through hire-purchase agreements

On 12 June 2024, the Central Bank wrote to firms that provide motor finance to consumers using credit intermediaries to tell them to end the practice of discretionary commission arrangements. The Central Bank took this action following a review of this practice in the motor finance hire purchase sector. We concluded from that review that the incentive these arrangements create is not consistent with new rules we will be introducing for the sector under our Review of the Consumer Protection Code. We are requiring the firms in question to take this action now, ahead of those rules coming into force.

Dear CEO Letter Discretionary Commission Arrangements in motor finance arranged through hire-purchase agreements | pdf 121 KB

Payment Account Services List

On 18 April 2018, the Central Bank published the Payment Account Services List as required under the Payment Account Regulations 2016.

Implementing technical standards with regard to the standardized presentation format for the Statement of Fees and Fee Information Document required under the Payment Account Regulations 2016 were published in the EU Official Journal on 11 January 2018.

Payment Account Services List | pdf 330 KB

EU Official Journal 11 January 2018

Other Documents

Documents which other firms, not subject to the Consumer Protection Code, must have regard to in relation to consumer protection issues are listed below:

MiFID – Feedback on Discussions of Conduct of Business Industry Working Group | pdf 1003 KB