Introductory statement by Governor Philip R. Lane at the Joint Committee on Finance, Public Expenditure and Reform, and Taoiseach

04 April 2017

Press Release

Chairman, Committee members,

I welcome the opportunity to appear before you today. I am joined by the Acting Deputy Governor (Financial Regulation), Bernard Sheridan, and the Director of Enforcement, Derville Rowland.

In my introductory statement, I will focus on three topics: the Central Bank’s Tracker Examination; the role of the Central Bank in supporting initiatives to reform the motor insurance market; and Brexit. I will address each issue in turn.

Examination of Tracker Mortgage Related Issues

Let me begin by stating that I fully share the Committee’s concern about tracker mortgage related issues. Where these issues have arisen, it is clear that lenders have failed their customers. Moreover, I am acutely aware of the unacceptable impact that these failures have had on tracker mortgage customers, from the burden of paying more than they should, up to instances involving loss of ownership of mortgaged properties.

I recognise that Committee members are frequently dealing with such cases in their constituencies and acknowledge the Committee has heard powerful testimony about the effects that these failures have had on individuals and families. We too are aware of these cases from callers to our own public helpline and from our ongoing engagement with consumer representatives, and these important sources of information continue to inform the Examination. The Central Bank is pursuing a comprehensive industry-wide examination precisely to ensure lenders identify every impacted customer, stop the harm, and pay appropriate redress and compensation.

The fair treatment of tracker mortgage borrowers has been a key supervisory and policy focus for the Central Bank over the past number of years. In line with our mandate to ensure that the best interests of consumers are protected, the Central Bank intervened with a number of lenders over the 2008-2015 period on a range of different issues in relation to tracker mortgages. These interventions ranged from lender-specific supervisory and enforcement actions to, more generally, strengthening the statutory protections for tracker mortgage customers (specifically the Consumer Protection Code and the Code of Conduct on Mortgage Arrears).

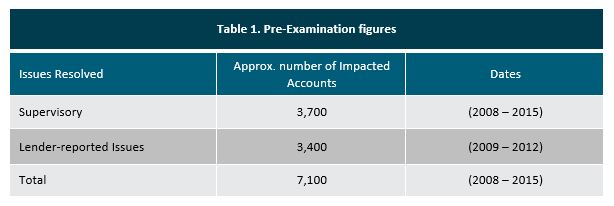

During this period, we dealt with a range of lender specific issues resulting in approximately 7,100 customer accounts affected by various tracker issues being resolved prior to the commencement of the Examination. We also intervened in a number of additional cases to prevent detriment to tracker customers before it actually occurred. Other issues were being actively investigated at the time of commencement of the Examination and are now being dealt with as part of the Examination or, where necessary, have been escalated for enforcement action.

Where appropriate, the Central Bank required certain lenders to offer affected customers the right to return to a tracker rate and/or payment of redress and compensation. The Central Bank also commenced enforcement investigations into tracker mortgage-related matters at Permanent TSB plc and its subsidiary Springboard Mortgages Limited. As a result, these lenders were required to implement a comprehensive Mortgage Redress Programme to address the issues identified.

Although the underlying characteristics of each issue differed, the Central Bank decided to launch a system-wide examination in 2015, due to the nature and potential customer impact of the issues identified. Importantly, the Examination’s scope also now requires a robust review to identify and deliver fair outcomes for all other affected customers, in addition to those cases known to the Central Bank at commencement.

The Tracker Examination is the largest, most complex and significant supervisory review that the Central Bank has undertaken to date in respect of its consumer protection mandate. It has involved an initial review of the total mortgage book by lenders in the relevant period which amounted to more than two million mortgage accounts. In line with our commitment given at the commencement of the Examination, we have been publishing regular status updates in respect of this ongoing supervisory work, the most recent of which was published last month and has been provided to the Committee.

The aim of the Examination is to ensure that all relevant lenders conduct a comprehensive and robust review, which delivers fair outcomes for all customers.

I note that several lenders have recently apologised to the customers whom they failed. Let me be very clear on the Central Bank’s position: a lender’s apology is meaningless unless the lender both stops the harm to all impacted customers and provides appropriate redress and compensation for the suffering caused. Lenders now need to demonstrate that they are doing everything possible to ensure this happens.

For our part, this is precisely what the Central Bank is determined to ensure.

We have put in place a comprehensive framework for lenders to conduct the Examination and provide appropriate redress and compensation to impacted customers. The framework also requires each lender to appoint an external independent party to oversee the conduct of its examination.

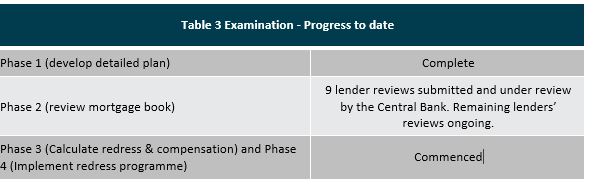

The framework for the Examination is a phased approach. Phase 1 involved the development and submission of detailed plans by relevant lenders. This phase has been completed.

Phase 2 requires lenders to conduct the review of their mortgage loan books in line with our framework. These reviews are extensive in that lenders must review the underlying loan documentation and customer files for the in-scope accounts to determine their specific contractual obligations, and also to determine if the documentation that each customer received had the potential to confuse or mislead the customer, both on a stand-alone basis and when read in conjunction with other communications – be they written or verbal – made to the individual customer.

In this respect, the Central Bank invoked its powers under Section 22 of the Central Bank (Supervision and Enforcement) Act 2013 to set specific timelines for lenders to complete Phase 2 of the Examination, the last of which will be completed by no later than end September 2017. The timelines have necessarily taken account of the size of the relevant lender’s loan book, the scale and complexity of issues in the lender, and the complexities associated with completing a thorough review, in line with the key objectives of the Examination.

By this date, the Central Bank expects all lenders to have identified all affected accounts, stopped further harm, and have commenced engagement with most impacted customers. The Central Bank is rigorously monitoring the completion of this work.

Phase 3 of the Examination relates to the calculation of redress and compensation for customers identified as having been affected by tracker mortgage related issues.

Phase 4 relates to the implementation of a redress programme in respect of these customers.

Phases 3 and 4 may run concurrently with Phase 2 and, as such, the Central Bank expects lenders to commence Phases 3 and 4 as affected customers are identified.

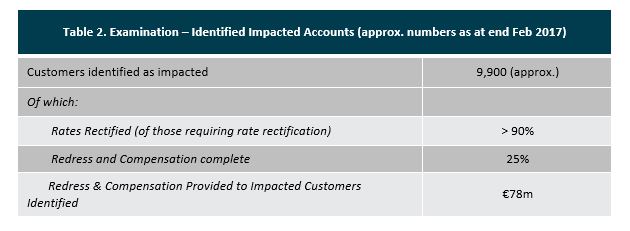

In that regard, and in accordance with our recent update, approximately €78 million has now been provided in redress and compensation to circa 2,600 impacted customers identified as part of the Examination. Separately, sums of €36.8 million and €5.8 million in redress and compensation have been paid by PTSB and Springboard Mortgages Limited in respect of 1,374 accounts impacted as part of the aforementioned Mortgage Redress Programme announced in July 2015, which predated the Examination.

Due to legal requirements which restrict the degree to which I can discuss individual firms, I cannot provide a detailed breakdown by lender as to precise numbers of customers and redress and compensation paid to date. I can detail aggregate amounts, however, and for the benefit of the Committee, I have provided the relevant tables in this statement.

It is also important to note that the Central Bank does not have the statutory power to compel lenders to implement redress and compensation programmes in respect of failures that occurred prior to the introduction of the Central Bank (Supervision and Enforcement) Act 2013. We were granted such powers, having sought them, in the 2013 Act.

However, I believe the Central Bank’s robustness of approach in this matter is evident from the Principles of Redress we have laid down and published, and with which we expect lenders to comply.

Our robustness of approach is also evident in the fact that it is not only our Consumer Protection Directorate, but our separate Enforcement Directorate, which is actively involved in the Tracker Examination. Where regulatory breaches are suspected, cases may be referred to Enforcement. We are committed to taking robust enforcement action aimed at promoting principled and ethical behaviour by and within regulated entities.

To date, the Central Bank has concluded an enforcement investigation in respect of tracker mortgage failures identified at Springboard Mortgages Limited and imposed a monetary penalty of €4.5 million on that entity in respect of the failures. The monetary penalty paid by the entity is the highest penalty ever collected by the Central Bank. This penalty is in addition to the figure of approximately €5.8 million which Springboard Mortgages Limited paid to affected customers as part of the Mortgage Redress Programme.

In addition to the investigation into tracker mortgage-related matters at Springboard Mortgages Limited and Permanent TSB plc referenced above, the Central Bank has also commenced an enforcement investigation into tracker mortgage-related matters at Ulster Bank Ireland DAC. We may also commence other investigations, as appropriate, into other lenders and persons concerned in the management of such entities where there is evidence of non-compliance with regulatory requirements. In this regard, enforcement activity will be influenced by the outcome of the reviews currently being conducted as part of the Tracker Examination.

In short, all possible enforcement angles, including potential individual culpability, will be thoroughly investigated and analysed in the context of the legal framework. Enforcement measures will be deployed as appropriate, including investigating issues and taking cases under the Central Bank’s Administrative Sanctions Procedure together with the use of our fitness and probity powers.

Boards of lenders are expected to ensure appropriate control, governance and management in those firms. In line with international regulatory standards, we operate a risk-based framework for the supervision of regulated firms. In its regular supervisory work, the Central Bank cannot pre-approve every single commercial decision taken or contract entered into by a regulated firm.

Supervision entails challenge of firms, judgment of the risks they pose to the economy and to the consumer, and mitigation of those risks we judge to be unacceptable. Targeted enforcement action against firms whose poor behaviour risks jeopardising our statutory objectives, including financial stability and consumer protection, underpins this framework. Consumers are further protected by the other relevant State bodies in this area: the Financial Services Ombudsman, the Competition and Consumer Protection Commission, and the courts. These form part of the State’s protection for individuals.

I acknowledge the Committee’s reflection that the Examination has taken some time and it will take some further time to complete, but I will reiterate that lenders are working to the specific timelines which we have imposed, and are required to examine all relevant individual contracts.

Given the harm that the actions of some lenders have caused, it is essential that the Examination be both comprehensive and robust.

The Central Bank, for our part, is determined to ensure that every impacted customer is identified, and appropriately redressed and compensated.

Motor Insurance

Turning to motor insurance costs, the Central Bank welcomes the focus that this Committee and that of the Cost of Insurance Working Group led by Minister Eoghan Murphy has brought to bear on this issue. As you know, the Central Bank appeared before this Committee in relation to insurance in 2016.

The Central Bank recognises that volatility in the price of insurance has an unwelcome impact on consumers. While the Central Bank does not have a role in the setting of premiums and, in common with all supervisory authorities in the European Union, is explicitly prohibited by European law from having one by Article 181 of the Solvency II directive, the Central Bank is committed to working with this Committee, the Cost of Insurance Working Group and other stakeholders on aspects related to this issue in ways that are appropriate to our mandate.

There were a number of common themes between the findings of this Committee’s final report and the work of the Department of Finance Cost of Insurance Working Group, of which the Central Bank was a member.

For example, both the Committee and the Working Group found there was scope to improve the renewal process to assist consumers in their purchase of insurance. Similarly, both the Committee and Working Group recommended substantive work be undertaken to improve data availability.

The Central Bank, through the Working Group process, is the lead owner for a number of recommendations and actions in these areas and work has begun on implementation.

In the area of renewals, the Working Group recommended that insurers provide additional information on the premium breakdown to consumers and that the renewal notification period be extended from 15 to 20 working days to make it easier for motorists to compare pricing when purchasing insurance.

Requirements for provision of information in non-life renewal notices are set out in the Non-Life Insurance (Provision of Information) (Renewal of Policy of Insurance) Regulations 2007. In order to amend these regulations, the Central Bank is required to undertake a standard consultation process, including engagement with consumer stakeholders and industry. The consultation will be conducted in Q4 this year, in line with the timeframes set out by the Working Group, with regulatory change, if required, in 2018.

In the area of data availability, the Working Group has recommended the establishment of a national claims information database. The Central Bank is currently working with the Department of Finance and other stakeholders to define key aggregated statistical data on motor claims for publication in the near future, which will, in turn, assist with the development of the database in 2018 as recommended. It should be noted, however, that the database function will represent an extension of the Central Bank’s mandate and will therefore require legislative change.

As I said at the outset, the Central Bank is committed to working with this Committee, the Department of Finance Cost of Insurance Working Group and other stakeholders in relation to this issue in ways that are appropriate to our mandate.

Brexit

Let me now turn to another priority area for the Central Bank: dealing with the implications of Brexit and the impact of this on the financial system and the economy.

Our forecasts are for relatively favourable growth in the near term, supported by continuing recovery in underlying domestic demand. Consumption and underlying investment is set to remain robust, supported by a strong labour market.

The outlook for the Irish economy however remains subject to uncertainty that pertains to a number of external risks, but most materially to Brexit and uncertainty regarding the post-Brexit trading relationship.

Last week the UK government triggered Article 50 of the Treaty, starting the two-year negotiation period. The European Commission has suggested that agreement would need to be completed by October 2018 to allow ratification by the UK and European Parliament before the two-year timeframe elapses. It is clear that this timeframe is very ambitious given the volume of issues which must be negotiated. It can however be extended if all Member States agree to this.

For the domestic banking sector, Brexit has to date had a relatively benign impact. Banks have not seen any funding impact or deterioration in credit quality. We continue to engage with all regulated entities to ensure they are adequately prepared.

It remains too early to accurately predict any Brexit-related effects on foreign direct investment. The Bank has however increased engagement with a range of entities including banks, markets firms, insurance authorisations and queries regarding payments and electronic money. Enquiries have taken the form of discussions on potential new authorisations, possible balance sheet expansion or changes to business type.

Where the Bank is asked to consider the authorisation of a firm in Ireland, the Bank will want to be satisfied that we are authorising a business or line of business that will be run from Ireland and which we will be effectively supervising. The Bank will expect there to be substantive presence here. For financial services, the Bank operates under a common framework for regulation and supervision. At a European level, regulatory authorities operate as part of the European System of Financial Supervision (ESFS) which promotes consistent application of European legislative requirements.

Potential new entrants pose a challenge to us as an organisation in terms of planning and prioritisation. However, we are meeting this challenge.

To fulfil our mandate in safeguarding stability, using a risk-based approach to supervising firms, and ensuring a robust and transparent authorisation and approval process, we established a Brexit taskforce within the Bank prior to the referendum. Our internal taskforce is a cross-departmental structure involving fifteen divisions across the Bank. This functional approach is necessary given the potential for a more diverse cross-section of entity types and business models of entities supervised across all sectors.

We have increased our capacity to deal with this, and contingency resourcing plans have also been developed.

Conclusion

To conclude, our vision is for a well-functioning, well-managed and well-regulated financial system.

However, legacies of the past are material and continue to be worked through. Trust in the system remains very damaged and reflects the need for continued improvements, including in underlying culture.

We endeavour to foster a strong culture of compliance, with firms and individuals within firms acting in the best interests of their customers backed up by comprehensive and enforceable legislation, rigorous supervision, a credible threat of enforcement and powers of redress when consumers have suffered detriment. As I have stated, although the Tracker Examination will still take some time, the Central Bank is determined to ensure that every impacted customer is identified and appropriately redressed and compensated.

On the issue of insurance, the Central Bank will continue to work with this Committee, the Working Group and other stakeholders in ways that are appropriate to our mandate.

Looking ahead, Brexit poses a number of risks and challenges for the economy, for institutions and for businesses. In line with our mandate, we will continue to highlight these risks, engage with institutions so they are adequately prepared, and provide a transparent and efficient authorisation process for any potential entities that choose to establish here.

I look forward to discussing these issues further with you as well as the other issues you raised in my invitation.