A macroprudential framework for investment funds

18 July 2023

Blog

In recent years, financial regulators across the globe have increased their focus on the risks posed to the financial system by the growth in non-bank financial intermediation (NBFI). As indicated last month, we have today published a discussion paper on an overarching approach to macroprudential policy for the investment fund sector. The paper aims to advance the international debate on this aspect of the regulation of the funds sector and I want to use this blog to set out some of the main issues it explores.

In recent years, financial regulators across the globe have increased their focus on the risks posed to the financial system by the growth in non-bank financial intermediation (NBFI). As indicated last month, we have today published a discussion paper on an overarching approach to macroprudential policy for the investment fund sector. The paper aims to advance the international debate on this aspect of the regulation of the funds sector and I want to use this blog to set out some of the main issues it explores.

Globally and in Ireland, the NBFI sector – and particularly its investment fund component – has grown significantly since the Global Financial Crisis. According to the Financial Stability Board (FSB), the global funds sector grew from €15 trillion in 2008 to €72 trillion in 2021 driven by both net inflows into the sector and valuation effects.

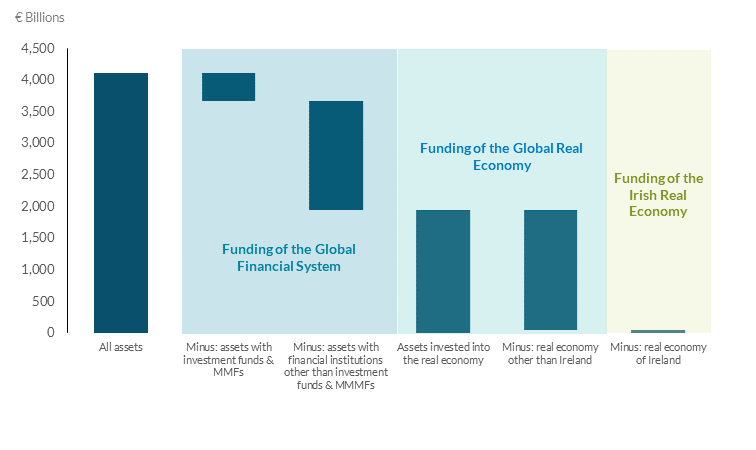

Ireland is now one of the world’s largest hubs for investment funds at a global level hosting the largest money market fund sector in Europe, with assets totalling over €700 billion in the fourth quarter of 2022. We are also host to the largest exchange traded fund (ETF) sector in Europe with total assets of over €900 billion, or about two-thirds of the total assets of ETFs in the euro area during the same period. The funds sector is diverse and includes a range of entities, with a variety of business models and investment strategies. The sector in Ireland is heavily interconnected globally, both with other parts of the global financial system and the global real economy (see Chart 1).

Increased financial intermediation via funds brings many benefits. First, it provides a valuable alternative to bank financing, which supports economic activity and helps to mitigate the impact of any disruption to banking-related funding channels. Second, the growth of the funds sector allows for increased financing of businesses through equity rather than debt. And third, the funds sector enables diversification of asset portfolios, with benefits for investors. Indeed, the benefits of a more diversified financial system are reflected in the EU’s policy agenda on Capital Markets Union (CMU).

Chart 1: Irish investment funds are providing funding to the global financial system and real economy

Billion EUR

Source: Central Bank of Ireland and staff calculations

Source: Central Bank of Ireland and staff calculations

Notes: Data as of end-2022.

However, like all forms of financial intermediation, the activities of investment funds can also pose risks that, in certain circumstances, can become systemically relevant. The underlying systemic risk posed by the funds sector stems from the potential of cohorts of funds to spread or amplify shocks to other parts of the financial system and the real economy, particularly in times of market stress. This was evident during the March 2020 COVID-19 shock where we saw how liquidity mismatches in open-ended investment funds exacerbated shocks to market functioning. More recently, the stress in the UK gilt market last autumn illustrated how leverage-related vulnerabilities in the funds sector can be exposed by rapidly-changing market conditions, and how such vulnerabilities can amplify shocks to financial markets.

In recent years, international bodies and organisations such as the FSB, the International Organization of Securities Commissions (IOSCO), the European Systemic Risk Board (ESRB) and the European Securities and Markets Authority (ESMA) have all been working on the role of investment funds and their relevance from a systemic risk perspective. Indeed, last week the FSB a published a Consultation Report to address vulnerabilities in open-ended funds while IOSCO published its own Consultation Report providing guidance on anti-dilution liquidity management tools. We have been heavily involved in this international work. Of course, as the nature of systemic risk is multi-faceted and constantly evolving, developing an overarching macroprudential framework for the funds sector would strengthen the overall regulatory architecture.

The main objectives of today’s discussion paper are to establish the case for systemic risk posed by elements of the investment fund sector, to present the need for a macroprudential framework for the sector, and to prompt and accelerate the discussion regarding the potential overarching framework itself. The paper explores what the objectives of a macroprudential framework would be and outlines key principles that could underpin its design. It also discusses potential tools that could be used to achieve the objectives and considers a range of practical issues that would need to be progressed to make such a framework operational.

Why do we need such an evolution in the regulatory approach? In brief, as the financial system changes, the regulatory framework needs to also evolve in response. The current EU regulatory framework for governing investment funds and fund service providers primarily deals with the protection of investors in the fund. This is obviously important, and can also help to address some fund-specific elements of systemic risk. But it does not address them fully. Indeed, as evidenced by recent episodes of stress, the current framework has not been sufficient to reduce the propensity of certain fund cohorts to amplify shocks in times of stress.

The aim of macroprudential policy for the funds sector would be to ensure that this growing segment of the financial sector is more resilient to stresses and less likely to amplify adverse shocks. In turn, it would better equip the sector to serve as a resilient form of financing supporting broader economic activity. Macroprudential policy can achieve this by preventing the build-up of excessive vulnerabilities across relevant cohorts of the funds sector and/or limit the potential for the sector to amplify adverse shocks through its interconnectedness with other parts of the financial system. This could be achieved through repurposing of existing tools or, potentially, the development of new, bespoke, macroprudential tools.

Our discussion paper takes a holistic view when considering the development of a macroprudential framework for the funds sector. While it does not propose specific policy measures, it does outline a number of high-level objectives and principles to be considered when developing such a framework:

- In the case of investment funds, resilience-enhancing measures need to work on a collective or aggregate basis, aimed at fund cohorts

- Resilience needs to be built before crisis conditions occur. Sufficient policies should be in place targeted at the identified sources of systemic risk, though ex post tools remain important as part of a wider toolkit

- Policy measures could either seek to limit underlying vulnerabilities and/or be targeted at the interconnectedness of the sector, reducing contagion risk

- Policies should have a degree of flexibility so they can respond to systemic risks as they evolve

- Policy intervention should be the result of a careful balance between costs and benefits for the broader economy

- Global co-ordination is a critical enabler when designing a macroprudential policy framework for the funds sector. And macroprudential measures should take a system-wide perspective and guard against the possibility that risks shift to other parts of the financial system.

As I have said on a number of occasions, given the global nature of the funds industry, a macroprudential framework would ideally have a high degree of consistency internationally. As we have previously identified in the context of our work on domestically-focused property funds (PDF 461.08KB), this includes the need for a reciprocation framework for macroprudential policies relating to non-bank finance, including funds. Macroprudential policies will be most effective if regulators co-ordinate. Beyond governance issues, a key operational challenge in developing and operationalising a framework for investment funds relates to data issues, including data gaps internationally. The importance of high-quality data to inform macroprudential analysis and policymaking means that regulatory authorities and policymakers would benefit from an internationally-consistent data framework. There should also be a framework that facilitates data sharing between national authorities that require access for macroprudential risk assessment, be they securities regulators, central banks or other macroprudential or financial stability authorities.

Conclusion

Today’s discussion paper does not attempt to provide all the answers to this important issue. In view of our role in maintaining financial stability in one of the world’s major financial sectors, we have a responsibility to play our part in the ongoing international debate on the NBFI sector. We very much look forward to engaging with stakeholders on the key issues and questions set out in the discussion paper.

Gabriel Makhlouf

Read more: