The Evolving payment landscape in Ireland - Remarks by Vasileios Madouros, Deputy Governor, Monetary and Financial Stability

04 March 2024

Speech

The payments ecosystem lies at the heart of our economy.1

In practice, of course, most people don’t spend too much time thinking about how payments operate.

But money, and the associated infrastructure that enables payments, are absolutely critical for people’s day-to-day lives and for the functioning of economies.

And, over the long course of history, we have seen both evolution and revolution in the world of money and payments.

From the silver pennies of Sitric Silkbeard in 997, to the first Saorstát pounds of the Irish Free State in 1928, the domestic adoption of cards as a means of payments in the 1990s, or entering a new era for money and payments, with our iconic harp featuring proudly on euro coins since 2002.

Looking back over the past decade

Given the focus of this morning’s session on the evolving payments landscape in Ireland, let me starting by looking back at developments over the period since the last National Payments Plan.

This was a little over a decade ago, but there has been remarkable change and innovation over this period, across different dimensions:

- How we pay in day-to-day transactions;

- Who is involved in the payments ecosystem; and

- The plumbing of the payments system itself.

How we pay

How we pay is partly driven by how we conduct commerce.

And how we conduct commerce has been changing dramatically, enabled by digitalisation.

Expanding internet connectivity, with 94% of households in Ireland now having access to the internet, has opened up the opportunity for commerce to move online.

The proportion of people buying goods and services online in Ireland saw one of the biggest increases across the EU between 2018 and 2023 and we are now 4th highest amongst our peers.

In parallel, increasing mobile phone penetration has brought the smartphone into the hands of many, with more than 9 in 10 Irish adults now reporting using a smartphone.

These trends are reflected in the changes we see in payments.

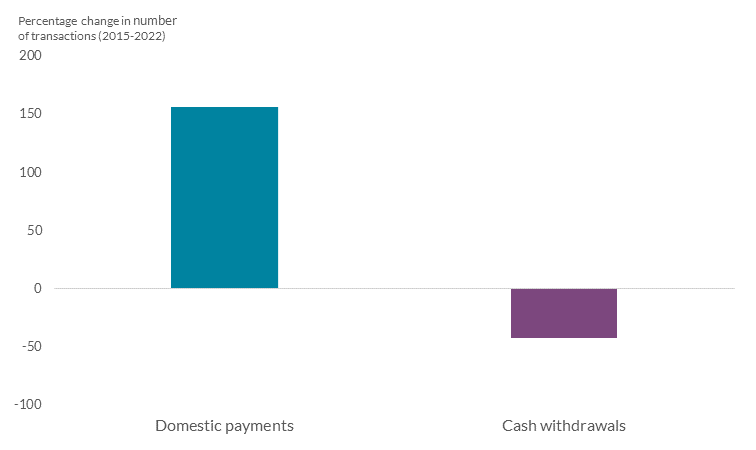

Of course, cash is – and will remain – an important means of payment for in-person transactions. But the number of cash withdrawals from ATMs has fallen by close to 40% since 2015 (Chart 1).

The number of domestic digital payments, on the other hand, have more than doubled over the same period.

At the time of the last National Payments Plan, contactless functionality was in the early days of adoption in Ireland.

Chart 1: Electronic payments have grown rapidly, as cash withdrawals have declined

By now, contactless payments make up around 85% of card-based point-of-sale transactions.

At the time of the last National Payments Plan, Apple Pay and Google Pay didn’t even exist in Ireland and the central role of mobile devices in many aspects of our lives was still evolving.

Mobile wallet payments now account for nearly half of all contactless card payments.

And, over the period since the last National Payments Plan, we have also seen the emergence of foreign digital banks offering mobile payments solutions in Ireland, enabling fast person-to-person transfers, with significant uptake domestically.

So, overall, Ireland – like many other countries – has experienced a very marked change in retail payments behaviour and a rapid shift towards electronic payments.2

The rapid uptake of new payment methods over the past decade illustrates Ireland’s readiness to adopt innovative payment solutions that bring greater convenience to people’s lives.

Players in the payments ecosystem

But it is not just the way we pay for goods and services that has changed. It is also the players involved in the payments ecosystem, often outside the traditional banking system.

Increasingly, the process of electronic payments has been disintermediated or ‘unbundled’.

A typical payment chain can now involve new entities, using new technologies.

And – as a very open economy, with specialised expertise in both finance and the technology sector – Ireland has developed a rapidly growing payments ecosystem.

Ireland now serves as the European headquarters for Apple Pay and Google Pay.

And it is home to over 50 payment and e-money institutions (Chart 2).

Chart 2: There has been a rapid increase in the number of PIEMI firms authorised in Ireland

In many instances, these firms do not provide services to our domestic market. Rather, they avail of their right to passport into other EU Member States.

Around 85% of PIEMIs here passport out to the wider European market.

So when we think of the payments ecosystem in Ireland, it is important to recognise not just the services it provides to the domestic economy, but also the broader European economy.

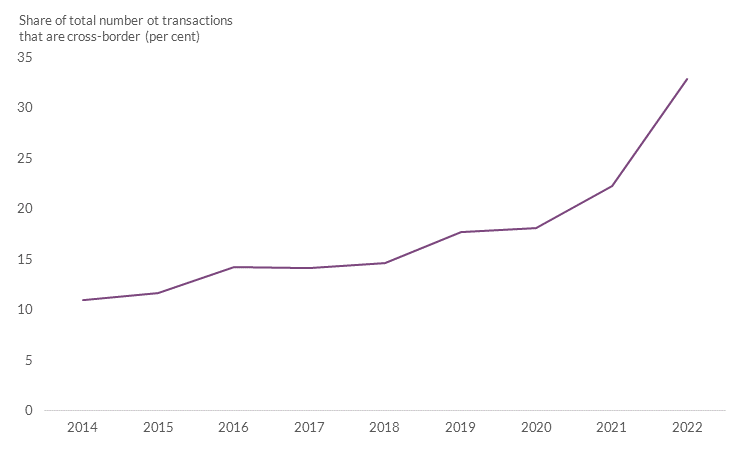

Indeed, the share of total payment transactions by Irish-resident banks and non-banks that are cross-border in nature has risen markedly in recent years (Chart 3).

Chart 3: Irish entities increasingly provide cross-border payment services

Payments infrastructure

Finally, since the National Payments Plan more than a decade ago, there have also been significant advances in the underlying payments infrastructure and standards supporting Irish retail payments.

Following the Single Euro Payments Area (SEPA) Regulation in 2014, Irish electronic credit transfers and direct debits migrated from domestic systems to the pan-European STEP2 system.

At the same time, Irish card payments migrated from the domestic Laser scheme to international card schemes.

And, at the top of the infrastructure pyramid, the Eurosystem’s Real Time Gross Settlement system, TARGET Services, now provides the Irish market with a consolidated platform for multiple services, including instant payments.

These infrastructure developments represent a major step forward for the Irish market.

They enable a greater degree of integration with the wider European retail payments market than ever before.

And they provide the necessary infrastructure that financial institutions can use to provide innovative payments services to Irish customers.

So a lot has changed over the past decade in the payments landscape in Ireland.

But there are also important areas where Ireland’s payments landscape is, still, lagging behind.

Most notably, unlike some other countries in Europe, account-to-account or ‘pay-by-account’ functionality, including for online transactions, is not widely available here.

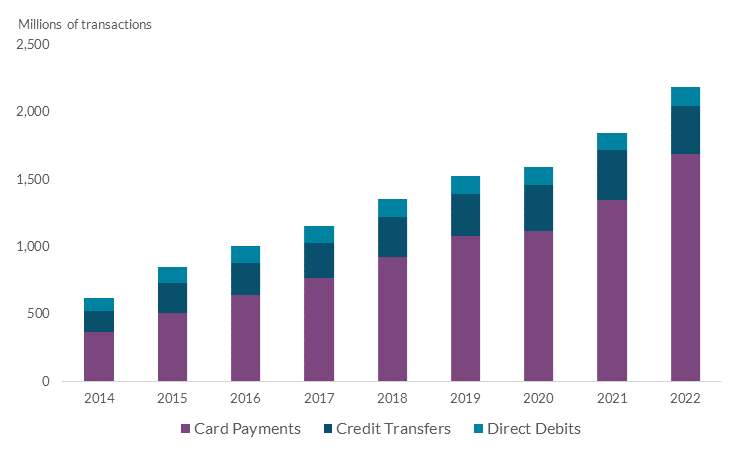

Domestic electronic payments are still dominated by cards (Chart 4).

Chart 4: Domestic electronic payments are still dominated by cards

Introducing the ability to pay with an account – whether through a bank, a credit union, a payment institution, or an e-money institution – is critical to expanding access and choice for the Irish market.

Of course, paying with an account does not exist in isolation.

It is dependent upon the market grasping the opportunities available to it – including instant payments, open banking and advanced anti-fraud measures.

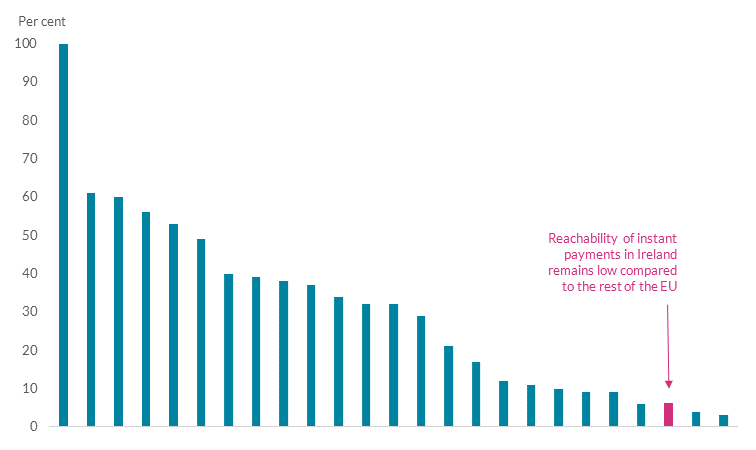

Despite the infrastructure of instant payments being available since 2017, material providers of payment accounts in Ireland have not yet implemented or adopted it (Chart 5).

The deployment of open banking, especially streamlined payment initiation flows through ‘one-click checkouts’, has been slow and its potential remains largely untapped.

Chart 5: Reachability of instant payments in Ireland remains below EU peers

This is a striking pattern. And, from the perspective of consumers and businesses, an unsatisfactory outcome.

Ireland is host to a growing and innovative payments sector.

Ireland is also the base of a very innovative technology sector.

And people have shown they are willing, and indeed eager, to embrace innovations in payments.

Yet a lot of the benefits of technology in relation to payments for domestic consumers and the broader economy remain untapped.

The development of the National Payments Strategy by the Department of Finance offers an opportunity to change that.

The Central Bank has been engaging closely with the Department of Finance on the National Payments Strategy and we look forward to continue playing our part.

Looking ahead to the next decade

So let me now look ahead.

What might the future hold and how can we use the National Payments Strategy to prepare for it?

It is, of course, very hard to tell where we might be 10 years’ time. Indeed, it would have been a fools’ errand to try and predict where we’d be today, a decade ago.

The pace of innovation is very rapid and there may also be developments which we may not even have thought about now.

But we can certainly anticipate continued change in the payments landscape.

This is partly due to continued innovation. For example, technologies such as DLT and tokenisation are likely to become more regular features of our financial system and our payments infrastructures.

And it is partly due to policy changes. At an EU level, there are many initiatives that aim to ensure that businesses and consumers are in a position to realise the benefits of innovation in payments.

So while the future is uncertain, let me outline some of the outcomes that – from a public policy perspective – the Central Bank would want to see in the future evolution of the payments landscape.

- Greater choice, driven by innovation. Technology and innovation have the potential to offer greater choice for consumers and merchants, supporting competition and catering for different needs and preferences. Which is ultimately what matters from a public policy perspective. To achieve that, it is critical that the domestic ecosystem takes a more strategic approach to payments, enabling it to move closer to the frontier of innovation, and deploying that to the benefit of consumers and merchants.

- Fully integrated with European infrastructure. The European single market is central to the success of the Irish economy. And payments are a key enabler of broader economic activity. In that context, developing payments strategies and solutions that are interoperable with the rest of Europe must remain a priority. Indeed, developing pan-European solutions for payments at the point of interaction is a key pillar of the Eurosystem’s retail payments strategy.

- Enhanced co-ordination between participants in the ecosystem. The modern payments ecosystem consists of a growing number of increasingly diverse participants. Harnessing the benefits of innovation and managing the risks requires a system-wide approach. Enhanced co-ordination, both within industry as well as between the public and private sectors, is required to build a solid foundation for the future.

- An adaptive regulatory and oversight framework. Ensuring that the regulatory framework adapts with the changing nature of financial intermediation and remains fit for purpose in light of innovation – both in terms of technologies and in terms of business models – is a necessary condition for providing people confidence over resilience and security of payments – and ultimately build trust. And given the make-up of the sector here, this is relevant not just for domestic consumers, but for broader European consumers.

- Public money as an anchor for a well-functioning payments system. The shift towards electronic payments has meant that we have seen a shift away from ‘public’ money towards ‘private’ money for small value payments. But public money is an anchor for a well-functioning payments system. This trend has two implications. First, we need to ensure that cash remains widely available and accepted. Second, public money itself also likely needs to evolve to meet society’s evolving preferences. Which is why central bank digital currencies are being investigated or developed around the world, including in Europe.3

Together, these would got a long way towards achieving our ultimate vision for the payments ecosystem in Ireland.

One that ensures access and choice; safeguards security and resilience; fosters innovation and inclusion; and promotes sustainability and efficiency.

What do we need to do to get there?

In the Central Bank’s submission to the Department of Finance’s consultation, we outlined four overarching priorities for the development of the National Payments Strategy that can contribute to achieving the outcomes outlined above.4

These reflect our multifaceted role in payments, including as and issuer (of cash); an operator (of infrastructure); an overseer (of systemic systems and payments instruments); a catalyst (for development and public benefit); and an authoriser and supervisor of firms.

So let me briefly summarise what the Central Bank judges to be key priorities as the National Payments Strategy is being developed.

Coordinated action to realize the benefits of innovation and integration in a European context.

At an EU level, a number of policy initiatives are under way to improve outcomes for businesses and consumers – including Instant Payments, Open Banking, anti-fraud measures, and inter-operability with EU retail payments solutions.

The National Payments Strategy can act as a vehicle for driving effective implementation of these initiatives in Ireland.

The immediate strategic focus needs to be on initiatives that enable the development of account-to-account payment solutions. This is critical for closing the ‘access gap’ between Ireland and Europe.

More broadly, though, the NPS presents an opportunity to ensure that the domestic retail payments ecosystem is in a stronger position to keep pace with emerging technologies into the future.

Safeguarding cash as a means of payment

Cash is – and will remain – a core element of the payments ecosystem – in Ireland and internationally.

Indeed, the Eurosystem’s cash strategy aims to ensure that cash remains widely available and accepted as both a means of payment and a store of value.

While the use of cash in Ireland has been declining, it is very clear that there is a continued societal and economic demand by households and businesses to be able to use cash as a means of payment.

In that context, the Central Bank welcomes the proposed legislative framework on access to cash.

This is an important public policy intervention, providing a mechanism for ensuring that any future reductions in the cash infrastructure provided by the private sector do not outpace society’s needs.

Of course, a given level of cash infrastructure entails both benefits and costs, and these needs to be balanced from the perspective of society as a whole.

If people’s preferences for different forms of payments continue to evolve, it would not necessarily be optimal for the cash infrastructure to remain static forever.

So we need to develop an approach for evaluating the societal costs and benefits of a given level of cash infrastructure, in light of changes in underlying societal preferences.

Maintaining security and resilience of payments

Security and resilience of payments are necessary preconditions for public trust in the payments system.

The Central Bank sees the National Payments Strategy as an opportunity to put in place initiatives that strengthen security and resilience of payments.

There are different dimensions to that, including:

- Additional measures to prevent fraud, for example, through more cross-sectoral information-sharing;

- Measures to safeguard resilience of individual institutions, especially of newer, more innovative firms5; and

- Measures to strengthen the resilience of the overall payments system, including through further system-wide contingency planning.

Enhancing data and analytical insights

Last but least. Evidence-based policy making.

Data and analysis are a critical enabler to drive informed policy decisions, and to understand the direction of travel for the future evolution of the Irish payments ecosystem.

But there are still both data and analytical gaps. We need to fill these, and this will be a system-wide task.

Understanding the relative costs and benefits of various payment instruments and methods to the payments ecosystem, and society at large, will give us important policy insights.

This will enable a better understanding of the incentives needed to drive the development of payment services that meet the needs of consumers and businesses into the future.

Conclusion

To sum up, the Irish payments landscape has been experiencing significant change, amid both technological and business model innovation.

It is particularly striking that, while Ireland hosts a very innovative payments sector, some of the benefits of that innovation remain untapped from the perspective of domestic consumers.

The National Payments Strategy offers an opportunity to change that.

It also offers an opportunity to take a longer-term view and develop a coherent, system-wide approach to the future evolution of payments, within a European context.

Like any societal transition, the technology-driven evolution in the payments landscape needs to be managed carefully from a public policy perspective.

Making the most of that opportunity will be critical. Because a healthy and competitive economy relies on an innovative, inclusive and resilient payments ecosystem.

[1] I am very grateful to Austin Carberry, John Geelon, Patrick Haran, Anne Marie McKiernan, Siobhan O’Connell, Karen O’Leary, Helena Roche, Bernard Sheridan and Mikela Trigilio for their advice and help with preparing these remarks.