Consumer Protection Code

27 May 2024

Blog

Consumer protection is at the heart of everything the Central Bank does. We are transforming how we regulate and supervise so that consumers remain well-protected and that their interests remain a key focus in the commercial decision making of firms. Back in 2022, we started a comprehensive review of our Consumer Protection Code (with the publication of a discussion paper (PDF 2.21MB)) aimed at ensuring that the Code remained fit for purpose and future-ready. As I wrote in a blog at the time, “the Code is a cornerstone of consumer protection in financial services in Ireland, establishing a set of rules and expectations for how firms should treat their customers and has allowed the Central Bank to intervene to protect consumers.” More recently, we are also enhancing how we organise our supervision to better achieve these goals.

We’ve now reached an important moment in the Review. Following engagement with stakeholders across the country (more on that below), we published a consultation paper in March setting out a number of proposals that will modernise, enhance and clarify consumer protections. The period for replying to the consultation ends next week, on Friday 7 June.

Why change?

Over the last decade, we’ve seen rapid change in financial services. Digitalisation and innovation is changing the financial products and services we buy and use and how we access them. Innovation in financial services has the potential to bring many benefits to the community; it is essential for a competitive economy and a well-functioning financial system that delivers for households and businesses.

But while change and innovation brings many benefits, it also brings uncertainty, challenges and risks for consumers. Consumers need to have confidence that the financial system will continue to secure their interests and work to achieve positive outcomes for them as products and services evolve. And at its core, financial regulation is about supporting positive outcomes, protecting consumers and investors, and, ultimately, contributing to the economic well-being of the community as a whole.

How we are proposing to update the Consumer Protection Code

Thank you to everyone who responded to our October 2022 discussion paper (whether directly and bilaterally, or at roundtables, or via the online public survey or indirectly through consumer research). Your views have helped to shape the proposals (PDF 1.64MB) that we are now consulting on and which I believe would deliver a framework that is more accessible to users while also providing clarity and predictability to firms on their consumer protection obligations.

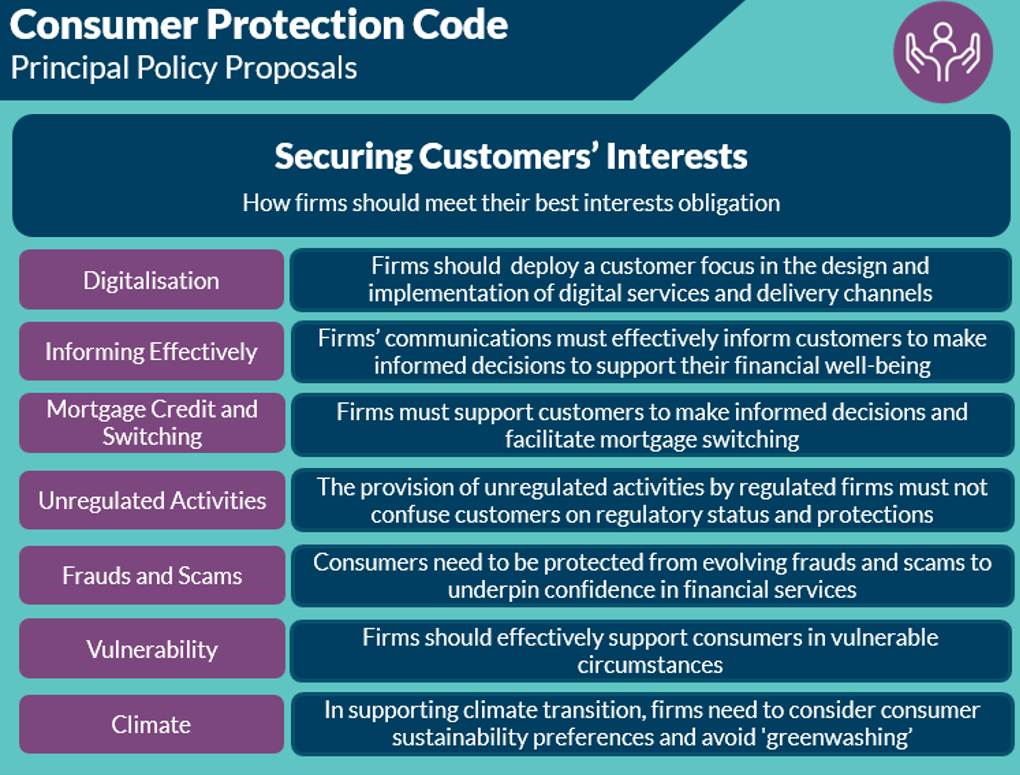

Consumers will benefit from a package of protections under the revised Code that reflect how consumers are accessing financial services today. Regulated firms will benefit from an integrated regulatory format, and a clearer articulation of their Code obligations. The table below sets out our principal policy proposals.

Consultation Paper on the Consumer Protection Code: Principal Policy Proposals

One of our key goals in updating the Code is to see a maturing of firms’ understanding and engagement with their obligations. In the first instance, we want to see firms protecting consumers through the application of a more customer-focused approach to their business. And we want firms to be proactive in addressing any issues that arise.

We’re also proposing to introduce new digitalisation requirements, which seek to ensure that firms deploy a customer focus in the design and implementation of digital services and delivery channels.

We want firms to communicate with customers more effectively, in a way that enables understanding and empowers customers to make decisions in their own interests.

Given the significance of mortgage credit and switching for many households, we are proposing a number of new and enhanced requirements, including disclosure requirements on switching options and the cost of incentives, to ensure consumers are supported to make informed decisions in relation to mortgage credit.

We are also proposing new requirements concerning the provision of unregulated activities by regulated firms. These will place obligations on regulated firms, to ensure that their customers have no impression or misunderstanding that they are purchasing regulated products and services where that is not the case.

As we all know, users of financial services are being targeted by increasingly sophisticated frauds and scams. We are proposing requirements to ensure firms are vigilant to the evolving risks to the system, and that they take appropriate actions to protect customers, particularly in a digital world.

We are updating our approach to vulnerability (and our expectations on firms) to recognise that customers can move in and out of circumstances that make them vulnerable.

We are also proposing new suitability and advertising requirements for firms to ensure they communicate fairly and clearly on product sustainability features (given the important role financial services and consumer preferences will play in the transition to a climate neutral future).

And, finally, we want the Code to be more accessible, and plan to support consumers and firms in accessing the information they need through new digital tools, explainers and guides.

7 June

As I mentioned above, the feedback on the consultation closes next week on 7 June. Find out how you can make a submission.

Gabriel Makhlouf