COVID-19: The Irish Economy in a Global Context

15 April 2020

Blog

Nearly every country, society and economy around the world is trying to make sense of the COVID-19 pandemic. Governments everywhere are trying to ensure their health systems will cope. Medical experts are devising strategies to mitigate and suppress the spread. Policymakers are trying to assess and respond to the economic shock. Citizens, households and businesses, which make up the economy, are trying to cope with the new arrangements, reassess their finances, and manage a very uncertain and challenging time.

Why is the global context so important for Ireland, and the Irish recovery from COVID-19?

The Irish economy is both small and globalised and as a result is more sensitive to developments around the world. It is considerably more volatile than its peers across a range of macro-financial variables and we are more prone to structural macroeconomic shocks. But our openness and connectedness is also a source of strength.

Ireland’s highly-globalised nature can be seen in its reliance on the activity of foreign-owned multi-national enterprises which make a significant contribution to the Irish economy in terms of jobs, exports, fiscal revenue, and value added. Multinationals directly employ 14% of people working in the country.

The path of the Irish economy out of this crisis will depend on the path of the virus both domestically and globally. How well the world as a whole manages the pandemic matters to Ireland.

The global economic outlook

Yesterday the IMF published its regular biannual update for the global outlook. It will not come as a surprise that the analysis is sobering on the challenges that we face around the world.

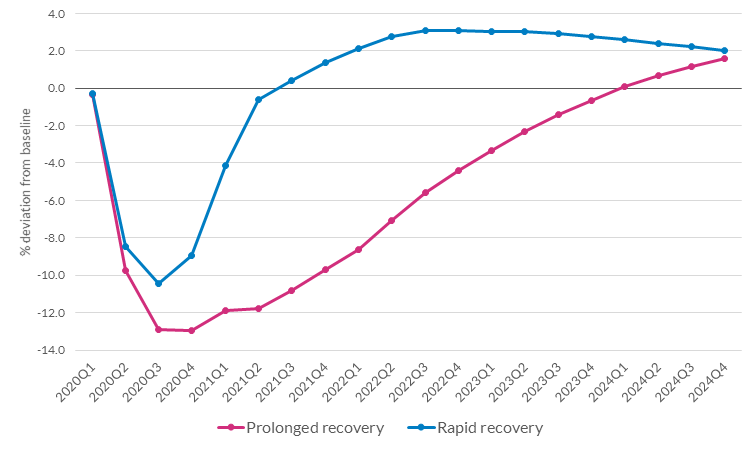

The global economy faces a sharp slowdown which is projected to be worse than the global financial crisis. The IMF expects a recession in 2020, with the global economy expected to contract by 3 per cent. If the pandemic can be brought under control in the coming months, the IMF suggests we would experience a strong rebound next year. Of course these estimates are surrounded by huge uncertainty around how the pandemic unfolds. Worse outcomes are certainly possible: if the virus persists, so too does the economic disruption. And I’m sceptical about a V-shaped recovery; I expect it to be more gradual.

The economic crisis we are facing has been caused by the pandemic and, in the short-term, we need to focus on managing the immediate disruption. But we also must plan ahead and aim to exit the crisis in a position that allows us to recover as rapidly and as strongly as possible. The global recovery rests on the global response to COVID-19 and, ultimately, on our ability to contain the spread of the virus and find a vaccine. It will require global cooperation and coordination. From a global perspective, Europe is relatively better-placed to respond to the pandemic but health systems in developing economies are, in general, less well-equipped as those in more advanced economies. And if we are to return to normality, the virus must be contained not just in Ireland and other advanced economies, but all around the world. Well-functioning and well-resourced global financial safety nets are crucial to provide support where needed. The world’s recovery matters to Ireland’s recovery1.

Figure 1: Quarterly World GDP, IMF World Economic Outlook (Dashed lines indicate estimates from January 2020 World Economic Outlook, 2019:Q1=100)

The economic shock caused by the pandemic requires a response from a wide variety of policymakers. To limit the economic fallout, government policy has in general tried to preserve economic relationships between employers and employees, producers and consumers, and lenders and borrowers. This is critical: households and firms across the world must be supported so that they can be part of the recovery.

First, fiscal authorities are indispensable in this crisis, most obviously to save lives by supporting health systems. Fiscal policy is also hugely important to mitigate the economic impact by supporting households and businesses. Make no mistake, even with well-targeted and reasonably efficient measures, the impact of the pandemic on public finances around the world will be large – but absolutely necessary. Second, central banks and financial regulators have taken measures to ensure that economies are well placed to recover. This includes ensuring that financing costs for companies, households and governments remain low in these exceptional times and that the flow of credit from the banking sector to households and firms is maintained.

These concerns are global and Ireland is no different. We are experiencing a serious outbreak of COVID-19 and have taken necessary containment measures to slow its spread.

The Irish economy

At home, COVID-19 is having a severe impact on the economy. Activity and employment have dropped sharply and this will continue for some time. Our recently-published Quarterly Bulletin focused entirely on the impact of the pandemic.

Our analysis suggests that the unemployment rate, when adjusted to include all those on temporary income support from the government, could rise to almost 25 per cent over the April-June period. However, when the necessary containment measures are eased, the economy should gradually begin to recover and people will be able to return to work.

Figure 2: COVID-19 Illustrative Scenarios on Irish Output

Irish authorities, often in cooperation with their European counterparts, have implemented a range of measures to contain the depth and duration of the downturn. Fiscal measures implemented by the government include additional healthcare spending, income support measures and support for businesses. These targeted measures are appropriate at this point in time, unlike a broader fiscal stimulus (given households are restricted in their ability to spend).

You’ll have seen that the ECB has made enormous financial firepower available across the euro area – monthly purchases under our Asset Purchase Programme and Pandemic Emergency Purchase Programme will amount to just over €1 trillion between now and the end of the year (PDF 738.45KB). The Eurogroup of Finance Ministers has also come out with a package of €500 billion. Forceful, coordinated and ambitious action remains necessary to ensure the impact of the shock is no longer and no deeper than it needs to be. All EU governments and all EU institutions need to play their part. From the ECB’s perspective, as our actions have shown, we stand ready to support the citizens and economies of Europe if events show that we need to do more.

One of the main aims of these measures is to reduce the amount of ‘scarring’ inflicted on the economy during this slowdown. By scarring, I mean the number of jobs lost and the number of firms that go out of business permanently. The crisis will have longer-lasting effects on the Irish and European economies if otherwise viable firms go out of business due to the pandemic. Likewise, if people lose their jobs permanently, they cannot return to work when the recovery takes hold. We want to avoid such an outcome.

Given the severity of the shock we are facing, there may be some persistent effects on the economy but we should look to minimise these and allow the recovery to take hold. Businesses will be able to restart their operations, workers will be able to regain their incomes, households and firms will be able to begin spending and investing again, and our economy can return to a positive place.

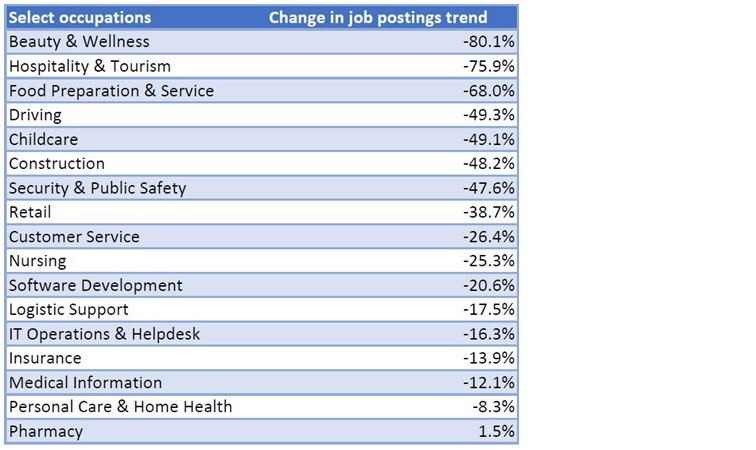

Although there are many uncertainties, we are trying to assess the impact of the economic shock using a variety of real time data. For example, today we published an (PDF 946.55KB)Economic Letter (PDF 946.55KB) looking at labour demand. Again Ireland’s openness and global nature are in focus. The mitigation and suppression measures abroad affect us here. The paper shows that job opportunities in the hospitality, tourism, personal services and some retail sectors are falling fastest, with Ireland one of the hardest hit countries.

Table 1: Job postings trend on Indeed as of 3 April 2020 (vs. same day in 2019) (PDF 946.55KB).

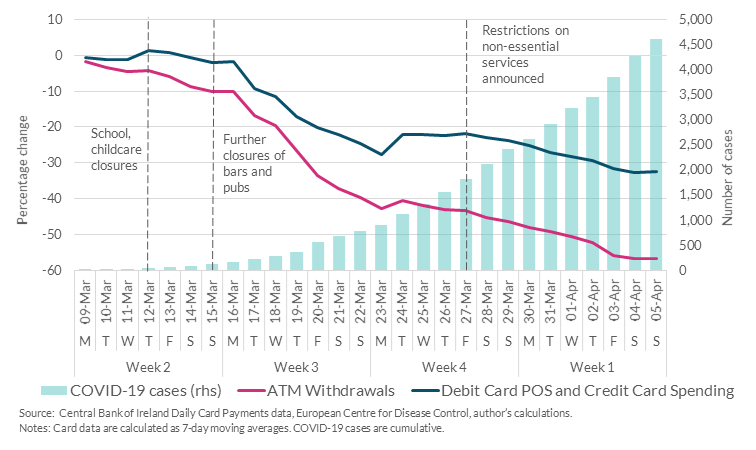

Other colleagues have published a “Behind the Data” article, monitoring daily retail card payments and cash demand during the COVID-19 pandemic. The data show spending patterns since the outbreak of the pandemic in Ireland. Retail card spending (point of sale and credit card) had declined by 27 per cent when compared with the first week of March, and cash withdrawal amounts had almost halved.

Figure 3: Decline in card spending and cash withdrawal over March -% change on first week of March

While it is natural to focus on domestic aspects of the current economic crisis – the closed offices, restaurants, bars, etc. – we cannot lose sight of what the global economic outlook means for the Irish economy. The sharp decline in external demand will have an adverse impact on the exports of local firms. And the economy’s integration into global supply chains means that the disruption to global trade is also likely to have a negative impact on Irish exports. On the other hand, the sectors that proved resilient during the last downturn – pharmaceuticals and the broad IT sector – may prove so again.

The impact of COVID-19 on the Irish economy has been swift and severe. It’s difficult to assess how severe the final impact will be and when the recovery will begin. But, working with our European partners, we will spare no effort to contain the economic effects of the crisis and do everything in our power to protect consumers, households and businesses.

Gabriel Makhlouf

1 See the Peterson Institute for International Economics briefing ‘How the G20 can hasten recovery from Covid-19.’ See also the latest scenario analysis from the Office for Budget Responsibility in the UK, any significant impact on the UK economy is likely to also impact on the Irish economy.

Read more